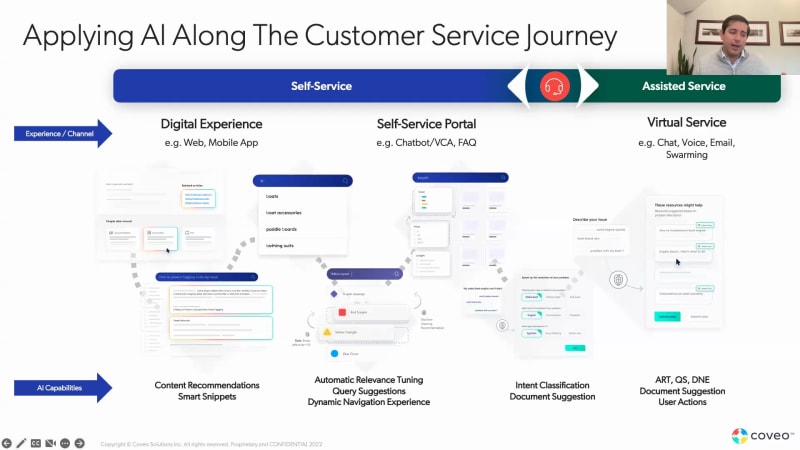

Welcome to today's session, for financial services trends that can make or break your customer relationships in, twenty twenty three. My name is Devin Poole. I'm a senior product marketing manager here at Coveo. Really thrilled to be joined this morning by Jim Marous. Jim, you've been in the game quite a a long time here. Not saying that you're old by any means, of course, but, rather, I know that you've been talking to financial institutions. You've been talking to service leaders, and, you know, what we're gonna share here today is is ultimately about the relationships that banks are trying to build with their customers. And so, I'd love to just, you know, kick it to you to say good morning and, talk a little bit about some of the things that you're hearing when it comes to how hard it's been to build relationships these days. Well, you know, it's interesting, Devin, and thank you so much for having me on. It it it's interesting because we may not be breaking relationships. The challenge is people are just intermediating their relationships. You know, I I talk about a lot of times about open banking, and we we talk about open banking, like, it's something that's driven by the financial institution. I would hazard to guess that if we did a room of two hundred people, a hundred and eighty of them would already have open banking within their own relationships. In other words, it's not driven by the financial institution, but I have a financial institution relationship with my personal bank. But I also have three more major personal banking relationships that work around that. In addition on my business banking side, I would have you to say that that my business bank is simply the holder of my deposits, and the reality is my relationship has expanded beyond that. So what we're having is people aren't leaving, so it's not breaking the relationship, but it's certainly making it weaker. And and we're gonna be talking about it today, but I think the biggest trend that financial institutions have to be aware of is that consumers, small businesses, and corporations have the ability to disintermediate their loyalty to you in a click of a button Yeah. More than they've ever have. In addition, partially because of COVID and the pandemic, we are more impatient than ever. We know we can make that change. We also realize when we talk about all these elements, that there are more examples of how partnerships have to relate between me and the businesses I work with, including financial institutions. That if you're not going to show me that you know me, understand me, and are willing to reward me, making my life easier and understanding my journey, I'll find somebody that does. Yeah. And that's the hard reality we have right now is that we're not breaking relationships, which it would almost be easier if we did break them because at least we'd know how big the problem is. What's happening now is they're kinda cracking around the seats, kinda like kinda like my iPhone right now that has a little crack on the side, but it keeps on getting bigger and bigger. We've gotta work for it. Yeah. Until eventually, the whole phone doesn't work any longer, and you can't get the things that you need. You know, it's what, we used to call when I, you know, did research into the financial services organizations, way back when, you know, death by a thousand duck bites. Right? Exactly right. Yeah. None of them are entirely painful, but we are losing and as we'll dive deeper into this, ultimately, you know, what you're losing is the access to a lot of information, a lot of intelligence about your customers that can help you to, be smarter, help you to deliver the type of service and relationship that they need from you, well, that's driven ultimately by, you know, how well we're able to capture, to analyze, and, of course, to use and put into action all of the the information, all of the data that we have about our customers. Right? But And and, actually, also, Devin, is that we've never had to do this quicker. Yes. So we don't have an excuse. We cannot be early, you know, fast followers anymore. We've gotta make changes very quickly and deploy them. You know, you you brought it up. It's not about, you know, learning and building great reports around what we know about the customer. It's letting the customer know we know about them, which is a big difference between what we've done before and what we need to do now. Yeah. Exactly right. It's about being on the front foot, getting proactive, getting preemptive, so that we can help customers start to to move forward. And as you said, you know, banks, haven't always been known as the fastest innovators in the game. You know, what's interesting is, I I I was talking with our our content leaders earlier this week about, you know, how can we write, some information? Because, man, we've helped organizations from all types of industries to, you know, start to move forward with the way that they build relationships. So there's a lot of learnings from other spaces. And, so thanks in advance for tipping off a piece that we're we're gonna write, you know, probably early in the new year about what lessons can we learn from other organizations. Now, of course, you know, all of this, Jim, it it comes against the backdrop of the the world that we live in today, and, man, isn't that world chaotic? Right? I I just sort of pulled some, headlines here that, sort of set the the backdrop for the these trends that you and I have been tracking here. Right? And if we just take a look at some of these headlines, right, well, confidence is low amongst consumers. It's declining and keeps declining. You know? And anyone who's followed the sort of, the the Edelman Trust Index over the last decade or so, see that, you know, consumer confidence, consumer trust in big organizations, and we deal with some pretty big organizations, in the the banking world. Right? So, that's become pretty low. Trust is a huge factor these days. You know, you see things like, oh, are we going into recession, or are we not? You kind of see those in the middle two here. Right? It's like, well, there there's a domino effect of, FTX's fall and maybe other cryptos are gonna fall, but then you see things like Dogecoin and Bitcoin, making gains. You're going, what's going on here? Right? And maybe we'll avoid a recession. Maybe we'll not avoid the recession. No one knows. So, you know, in all of that world, right, what you see is just a lot of confusion. You you see people trying and testing things. What what do you see? A key element, Devin, is that it is a confusion. You know, I don't think there's a a a social moment I get together with people that in fact, we had one this last weekend. We had an adult pajama party, which was one of these fun events, but somebody pulled me aside that I know you're in banking. What do you think is gonna happen in the stock market? What do you think is gonna happen in crypto? And I have to say that, you know what? I don't have a clue. But what I do know is I want somebody to be on my side, and this is one major element in the financial institution world that in the past, we were satisfied with simply giving consumers products. Yep. And then we move to giving consumers experiences. What they really want more than ever is a partner that's gonna help them maneuver around all these changes and do so immediately. It's not like your financial institution is gonna know that the crypto Barca gonna have a challenge or that the stock market may go up or down. What they will do, and they have a capability of doing, is being quickly reactive and telling you, oh, by the way, we see this happening right now. This is what we'd suggest. And I think the consumer more than ever knows that financial institutions can do that. They can take insight. They can look at my journey, and we can help them, the consumer, help maneuver around these challenges. It's not gonna reduce the amount of confusion, but what it's gonna do is say, at least I have an ally. At least I have an empathetic partner that can help make my life easier. Yeah. That that's it. The the way that you reduce uncertainty in, you know, the a relationship between, in this case, a a bank and, you know, individual customers is by transparently and proactively providing information to that customer based on everything that we know as an organization about you and about others like you, people in your situation. Here's what's been going on. And, you know, that that's a a lot of what people have come to expect these days. Right? And what we'll dive deeper into that as we sort of walk through, a lot of the the slides here. Right? But, suffice it to say, Jim, I think we're on the same page that there's a huge opportunity for organizations here today. Right? There's an opportunity that we can capture and cement relationships, especially, amongst the people who are going to, you know, have the largest amount of purchasing power over the next twenty, thirty years. Right? Banks are used to building relationships in one way with one set of customers, and now, that that's changed for all customers as we'll see in a minute here. You know, but that opportunity leads us right into, you know, these four, trends that that we've been following. We'll unpack each of these across the the rest of this session here. But the the opportunity here is for banks to start to build these relationships and and relationships that will last, you know, with consumers whose preferences are changing. So, you know, let let me walk through each of these at a high level, just talk a little bit about them, and then we'll dive deeper into them, Jim. You you and I, really gonna be curious to hear your comments, your thoughts as we go through all of this. But, you know, the the top one, you know, it's I I debated, with with you as we were setting this up saying, you know, is this even a trend anymore, or is it more of a truth these days? Right? Digital is the hub of consumers' financial lives, full stop. And and I think that's the big difference. Right? It's full stop these days. And the best part of this is this is something that's a win win for customers, for banks. This is a huge opportunity that we have to capture. Right? This is something we can take advantage of, if we position ourselves well, and we build the type of digital experiences customers want. The the second one here, you know, to me has always been a a back and forth. Right? Because it's customers will share personal information. Right? They will, but only if it benefits them. Right? I no longer want to you to be using my information for whatever you've been using it for. I want it for me. Right? Now is my time as a consumer to be a little selfish because of something you said earlier. I can, you know, add a new product from a different institution in the push of a button, and all of it takes place on this one little screen that lives in my pocket. Right? So, the the idea that Yeah. Decision to them because I'll share information if it benefits me from a simplicity and loyalty standpoint. So Yeah. What it may it's not cross selling here. What it is is making my life easier. Amazon is a great example. Yeah. Amazon is not about them continually pushing out a sale. What they're making is so when I do any search, when I I go to their site for anything, they're gonna prompt me and say, oh, by the way, do are you here to repurchase something that we know you're on the cycle about two months? Are you here to repurchase this? And if I simply do a search of something out, you know, let's say a pair of shoes, they're going to avoid those things that they know I'm not gonna be interested in. The more I buy, the more likely they are just focusing on what I probably want as opposed to those things I don't want. So when it again, we're looking at simplicity, which it gets into number three, gets into simplicity and loyalty, but more importantly, it gets into empathy. Yeah. You know, nobody is talking to very few. I'm not gonna say nobody, but very few people are talking to Amazon saying, take me off your list. Take away all the information you know about me. Take away my payment options. No. Most people are saying, you know what? You've never messed up very badly on what I want. And in fact, when I mess up, you save me. You know, if I buy the wrong size or the wrong color, and I have a problem with it, not only do you get me something out there the next day, but in some cases, you say, don't even return what you didn't like. It's more hassle for us to get back into it. This is setting the mindset of the consumer to what they want with every one of their partners, including their bank or credit union. Yeah. Exactly right. It's you know, the I I always make a a synonymous simplicity and convenience. Right? The world is so convenient these days. Right? So that I expect it to be simple. I expect it to be easy. And when it's not, you know, I I kind of revolt or I look for other options that are out there. You know? And, something that that most of the examples come up, Amazon's a great one. You know, they put relevant information in front of me. You know, whether I've made a purchase, and here's the next thing that you need to compliment that purchase. Right where I bought last year a, a big outdoor projector for our house so I could have movies with the kids outside. And now the next things that I'm seeing them are, oh, do you need a big screen? Oh, here's some inflatable lawn furniture. That's great. It's like the things that make that experience together. Now the the key for a lot of organizations, again, to to numbers two and three to me is customers are really used to you doing this when you want to sell them something. But the the key is it's not as you said earlier, Jim, it's not about the next product. It's about helping me get value out of the things I already have. Right? Help me make the most out of what I already have. Solve problems for me when I have them in a simple, easy way. Use the data that you have about me in order to personalize and contextualize, you know, those experiences when you're not trying to sell me something. And that's something customers have become very hypersensitive to, these days that, man, you're really, really good at remembering who I am, what I want, who's my family, all of these parameters of personalization when there's a sale on the line. Now I need you to show it when there's not. Right? I need you to start to look at my information and say, hey. By the way, you really ought to be taking this budgeting tool. Right? We've looked at your transactions, and then this is the the thing you need to do. Wow. Help me use my money, wiser. Right? Help me see the thing. And if that leads to a sale down the road, fantastic. That's all the better. Right? That's long term loyalty. But you you can't just put it into action for immediate gains. It's gotta be about cementing and building that back and forth relationship. Because number four, Jim, you you know, we're we're gonna talk a lot about this one. There is competition coming in the banking industry that has never existed until the last five, seven years. Right? Like, we're we're not an industry that's used to competing with tech giants like Apple coming in and, you know, in some cases, you know, just nipping at the edges of what we do in order to disintermediate that relationship. Right? That opportunity is gonna be huge for organizations. Now, Jim, any last thoughts before we we jump into each of these trends and sort of pick them apart? It's interesting. Two things. Number one, the digital also makes it so we can capture more insight on the consumer, small business, or corporation. So digital is not only the way people transact, but it's the easiest way in the world that we can capture information about where consumer is, a small business or a corporation is, in their journey. When it comes to the non bank banks, I have an ease of doing a simple search to say, jeez, you know what? My financial institution isn't really helping me save. Let me see what's out there. I started using Acorns three and a half, four years ago. I've never saved more money in my life than I did with Acorns. Why? Because it made savings easy. They made it so that it happened in a way that was not painful to me. They gave me options, and they continue to give me insight into how I could use them better. It was not about, oh, they're selling the next service. They continue to inform me with content. In much the same way on my business side, PayPal said, hey. We're gonna transact we're gonna handle all your transactions, your inflows and your outflows, and they do that. In addition, because they understood what my business was, what my flow of funds was, they gave me a preapproved bridge loan for my small business. If I went to my traditional financial institution that holds my deposits right now, it would take me between seven and fourteen days to get a loan. I don't need if I need a loan, I probably don't need it for that long. I probably need it for a couple days, maybe a week. Well, I'll tell you what. I'm gonna pay for that simplicity of implementing a new loan with PayPal on a quick basis, then and and I'll pay more for it maybe than my traditional financial institution, but the risk is gone. Yeah. They know me. They understand me, and they're rewarding me. Yep. Exactly right. You know, all of these have a sort of subtheme that wrote that that slides through them. Right? It's about, you know, individual journeys, individual interactions, but then pulling those things together to a whole, you know, relationship journey, that life stage. Right? I am on the this, road to where. Right? Whereas, you know, someone who may be just coming into the workforce in their prime of their earning years starting a family, they have very different needs than someone who is getting ready to retire. Right? And the way that we build these relationships, the way that we show them things is gonna be different, and, you know, it's ultimately gonna be digital. Right? You you mentioned that that's how people transact these days. Absolutely. It's how they consume as well. Right? So we'll we'll dive deeper here in into this first trend. Digital being the hub of you know, we we put their financial lives because, of course, the audience, that we're talking to here are banks. But, man, this is true of all types of, interactions. Right? We have put the the mobile device at the center of what we do. It is what? Eighty nine percent of US adults now own a smartphone and use it daily or some astronomical number like that. You know, so it's becoming the the center. Put it this way. If my seventy seven year old father is, making payments and conducting his financial world online, he used to, just five years ago, drive to literally the next town over in order to, you know, pay his credit card bill with a physical check. He doesn't do that anymore. Right? So it's not just a trend that is happening amongst younger, individuals. It has become the norm for all consumers these days. And in fact, that's where we're gonna start to, you know, jump in here because on the left, right, you I've sort of put some consumer sentiment that we've heard is, I'll do it myself. Okay. It's a lie. That was what my five year old told me this morning when we were making breakfast. Right? But it's the same mentality that, customers want to do things on their own. Right? If you take a look at the the first, bullet point on the top left hand side, you know, fifty nine percent of all customers prefer self-service. That's not fifty nine percent of younger customers. That's not fifty nine percent of people under the age of four. No. That's all customers. So the first time in history, that balance has tipped. Now, of course, it gets much higher the the younger you go in the demographic, but still, baby boomers are at a fifty four percent of them who, prefer self-service. I want to do this on my own. So, of course, it's no wonder that eighty one percent of all banking customer interactions start in self-service. The problem comes at the bottom here. Only thirteen of those people that attempt to self serve succeed. Right? So people are starting. People are failing. So if you look right at the the top of the bullet points there, it's about the right issue. It's about the right channel, and it's about providing relevant information along the way. It's not one channel per issue because as we'll see in a moment, customers are on a journey. They're okay sliding from channel to channel as long as it is a a coherent, contextual information that is driven by relevant information. Right? As long as it helps me continue to move forward and I learn some things online, then maybe I actually have to conduct that business, in a chat or on the phone. That's fine as long as it feels like a flow. Well, you know, also, Devin, you you you talk about eighty seven percent of consumers that attempt sales service don't succeed. Yeah. Guys, that is not the consumer sale. Yeah. This is the bank sale. This is a consumer that wants to open an account using a mobile phone, and finds out it's a thirty minute process, or that you make them come into a branch to make a payment or to authenticate their existence. The reality is the consumer's expectations as to what it succeed, a success, and a failure is has changed dramatically. If I wanna open an account on a mobile device or on my computer, I want it to be in less than five minutes, preferably less than three minutes. Yeah. Very few organizations are at that level. That is a failure. In addition, we have to remember also, the beauty of the digital world is be able to track a consumer's path, their journey. So just because we say there's so many people that wanna use digital, doesn't mean they wanna use it all the time, doesn't mean they don't wanna humanize experience. Consumers now wanna humanize digital experience. This is vastly different than what we built. In addition, even more so, it's the ability to track the journey itself, allows you to understand where they're stumbling. Yeah. Where in the process did things fall apart? Did it fall apart on the website? Did it fall apart on the phone? Oh, by the way, am I always digital, or is that a backup plan for me? You know, all these numbers are extraordinarily deceptive, but one that's not. We are failing as an industry overall at making consumers' lives easier. In fact, at a time when the financial world is getting more and more complex, we're part of that problem. We're not as much a part of the solution as we need to be. Yeah. You know? And and that's it. You know, it is focusing, the the title of this slide. Right? It's a digital first. Doesn't say digital only. Doesn't say digital exclusive. This is a digital first world that that we live in. That's where people are going to start. And if you, you know, smartly transfer them along the path, well, they're gonna be happier with that. Right? It's about putting the right information. Maybe you need to transact the the this thing online. Right? Maybe this is going to require you to go into a branch. However, we can make that so much easier by saying, we've filled out ninety five percent of what you need to do. We do need to make sure you're real human. Of course, you don't want someone taking out a credit card in your name, somewhere else. And so, you know, this could be a part of it. Now, again, that's not a totally accurate example these days because, of course, you can pretty securely, figure out who someone is online. But the idea is that consumers are willing to go on this journey as long as they're informed, as long as we're putting the right information at the right time in front of them. Right? And doing that, in multiple locations. Right? And that's what you see on the the right hand side here. The world is moving to this very mobile centric world, where, man, I expect to accomplish lots of things, on my mobile device. In fact, the majority of customers, the bottom right hand side say they should be able to accomplish any task in the mobile app. And if I can't, well, it's just the push of a button till I'm moving on my own screen right from a a digital interaction to a human one by calling or chatting you, you know, and that is what customers want these days. So, how do you make that a reality? Right? How can you start to, deliver that these intelligent, interactions to customers all along the journey? Well, it's exactly what, you know, we've been doing for the more than fifty financial institutions that we work with here at Coveo. So kind of a busy slide here. Let me orient you to what we're looking at. Right? Along the top, you can see the customer's journey flowing from self-service through to assisted service. The the second row with that blue arrow will show you sort of where the experience happens. Right? What channel the this might happen in. And then along the bottom. Right? What are the the capabilities? What are the the AI driven capabilities, that financial institutions need to apply in order to create, this type of experience? So when the customer starts online right on the left hand side, you know, maybe they log in to the the mobile app, and they're looking at, you know, how to to make home improvements, right, that they're looking at how can I, you know, start to reduce my mortgage burden? Right, there are options that are available there. And based on what you know about that customer, based on what you know about their situation, what they're in, you ought to be able to pop smart content recommendations. Right? So where when Devin logs in, you know what I've done in the past. Right? You have that picture of, my overall relationship with you, what life stage I'm in, you know, what my last couple of transactions were, you know, what my overall financial health looks like. So that's where you're able to pop just conveniently put smart content recommendations. Based on what we know about you, here's the thing you didn't know that you didn't know. Right. So you can start to pop that there. However, as that might move into the customer saying, hey. There's something I need from you. Right? The first opportunity to engage someone is something they didn't might not have known that they need. Or if you can preempt it and, you know, no, man. This is the thing they're probably coming on to do, even better. You found the thing for them they didn't know they needed. However, as you move through this journey and a customer starts to tell you what they need, right through the self-service portal, that could be a chatbot, that could be an FAQ, that's dynamic. Right? That's what you need to start to have is, you know, this dynamic navigation experience. The opportunity to show different things throughout that journey as it changes. Maybe I start typing one thing, or maybe I've looked at three different articles, and I've still not found what I need. And then you can pop the the right type of, in a thing in front of me, the right piece of content, the right tool, or or, the the right, workflow for me to complete. Right? And that, is driven by, you know, automatic relevance tuning. That's our machine learning that continuously studies what have people been doing in the past, what has worked successfully? Of course, you know, the the ability to put lots of data. Right? So and we ingest millions of data points a day for our financial institutions, right, to say, this is what you ought to be doing next. Right? Based on where this customer is going, that can be tuned to be very specific. And then, of course, you know, suggesting, you know, documents, classifying intent. Years and years that that I, you know, advised, financial services leaders at an organization called CEB, which was then part of Gartner. You know, you would talk to people and say, do you know what customers are trying to do online? Do you have any idea of what the intent is? Nope. Very, very but we can tell you that. Based on what this customer's actions have been, of course, based on what they've put in their search box, really quickly, you can figure out what are people trying to do. Right? Smart, you know, suggestions of the right documentation for them. And, of course, as they move into an assisted interaction, the key is that you let people know what that customer has already done online. Right? So whether it's a chat, whether it's an email, whether it's voice, right, the ability to see a user's actions, whether it was in their last session. Hey. This person logged in ten days ago, and this is what they were looking at. This is what they were doing with us, versus, hey. They logged in ten minutes ago. This is what they're looking at. That gives that frontline rep the ability to personalize that, experience in ways that customers have come to expect. Right? This is that bring everything you know about me to the table situation. Don't make me repeat myself. You know, it's interesting. Some Yeah. Some of the big takeaways here also is number one, you you have to realize that while this looks nice and clean on a on a PowerPoint slide, the reality is it it isn't always linear. Number two, there can be a detour or an abortion of the the path at any point when the consumer feels comfortable. In addition, they can step skip steps. But most importantly, what Devon brought up is the importance of content. If you provide good content along the journey and you make the consumer's journey simple and understandable, they will buy on their terms. You don't have to keep on pushing product. I think what's also interesting in the assisted service area is very interesting. So we I talked about in the last slide or two slides ago, the fact about digital account opening. If you don't have a great digital account opening process, do you know when they when they abort the process, when they abandon their shopping cart? Do you understand what makes them abandon the shopping cart? Do you have a response immediately when they do so? How powerful is it if you have a bad process right now to be able to grab that consumer? At the moment of them leaving, get back to them digitally and say, we realize you were looking for something. We want you to we wanna help you. A very major bank, top three bank in the country, has a very broken digital account opening experience. They found that if they engage with the consumer when they immediately abandon the process, they were not only able to capture more of that relationship, they were able to make the experience positive. So what happened was we took something that could have been extraordinarily negative and made it almost a benefit of the organization because somebody immediately reengaged, said, we realized you got through three quarters of the process. You stumbled at this point. Let's finish it up for you. As opposed to the consumer going, somebody's got a better have a better idea of how this works. I'm going elsewhere. We're losing over sixty percent of the number of accounts that people wanna open digitally because we have broken the process. This major bank found that they generated a hundred and three percent of the business than they would have done otherwise. Pretty important. Yeah. And, yeah, that that's what you're saying. It it's about knowing your customer. Right? Who is this person? What are their likely needs at this stage? Right? And when that happens, we're able to recommend the right content to them at the right time. You know, which leads us into, you know, the this second trend, Jim. And I I'm gonna come back to you, right away here, right, to talk about just how important simplicity is to to customers these days. Right? Because we know that that they reward this experience simplicity on the back end, not just when you're trying to sell me a product, but when, you know, I have problems, when I have questions, I just need you to make it as simple as possible for me these days. So we'd love to to hear you talk a bit about, you know, why is this so important to consumers right now? Well, we don't have enough time in the day. You know? Not you and I. But the reality is, as a consumer, I don't have enough time. I'm gonna reward those organizations that make my life easier, and I will rail against those that don't. I have a couple examples, recent examples. Number one, I traveled to Atlanta and and on out to Las Vegas a couple weeks ago. In my journey, a very, very, very high end travel bag broke. I've had it for over ten years, and the reality was the handle came off. So I'm standing there with a a a travel bag with two spikes, which I knew I wasn't gonna get on any more flights with that bag. The ability to go and find an alternative from the same store, from the same company, was extraordinarily painful. Now my wife did it for me, but it was still very painful for me because I lived through that experience point by point by point. They talk about a lifetime warranty. They do not fulfill on that. What they said is we take we give you an alternative, we'll fix it. That was fine, but the experience wasn't good. I can I immediately communicated on Twitter because if it's not right, people will speak out? I'm a I'm a an example. Same thing happened this past week with a situation with a, a tux. Well, one part of it didn't work exactly the way it was supposed to. The the tide did not have a class, And that's the last thing, it's the only thing you don't try on. My experience for them, I said, you only have you have three ways to solve my problem. Number one, when somebody returns something, is it right? It's as it before it goes out, is it right? When it gets to the store, is it right? You do not fulfill your obligation to me. I will reward that when it goes well. I'll tell many more people about my bad experiences when it doesn't. Consumers don't ask for that much, but they want the basics to be right, in addition to the simplicity aspect. We look at I look at the difference between I have two sets of TVs, one in one place, one in the other. One is DIRECTV, and the other one is Hulu. The experience with Hulu is so much more rewarding than it is with direct with DIRECTV. DIRECTV, I gotta determine what I wanna record, and I'm not too sure if I wanna record it all the time. With Hulu, they prompt me and say, by the way, you've watched this often in the past, but another show's coming up. Do you wanna watch this now? And, oh, it's not that. We have other things that are simple, are very much like that. Again, these experiences are setting the tone for what financial institutions need to provide. Consumers know you have the ability to use data to drive simplicity and more importantly, empathy, which I pretty much put together. If you're empathetic about my needs, you're gonna make it easy. And, you know, it's a great great slide there where where, you know, one day of experience can can change their their Yeah. And stay with the brand. As you're talking about, I'm saying, man, this is exactly what we're talking about here. Exactly. You know? One bad experience. What was the flaw? Speed also. Yep. So if I have a bad experience, and I talk about it online, I kind of in the back of the mind say, I expect you to see this pretty quickly and give me an alternative rather than calling customer service. Also, an example is I had something go wrong. I started conversation, but as soon as I went to the place where they said, contact this person, it triggered a how did the experience go? And I'm going, guys, you you weren't listening, and you had a journey that was not set to where I was in the journey. I the last thing you want me to do is give you a customer experience rating now, but I wanna get the problem solved as quickly as possible. So, again, we and we just had Jay Barrett, the Financial Brand Forum, talk about the fact that the speed of which somebody responds to a bad experience, the speed in which you can respond to a transaction or a path that I'm going down is a way I'm gonna rate you. If I'm starting to say, jeez. I'm looking at questions around consumer loans, and you don't reach out to me, I'll go someplace else. Yeah. Exactly right. The the speed and convenience because I've got nearly any bit of information, at my fingertips these days. You know, and so much of that speed. Right? If you look at the the second stat along the top here, so much of the the problem for institutions. It isn't that they don't have the content. It isn't that they it's not available on their website. It's that people can't find it. Right? It's that thing is there. It's due to poor site navigation. Right? And that's the real, you know, kick in the teeth for a lot of banks these days. This is a problem that could have been, avoided in a an assisted service situation. That customer could have solved that problem on their own. The information was there. They just couldn't find it. Right. So we'll we'll dive into this in a second, but I I wanna quickly, ask you about the front line. Right? Because simplicity, convenience, speed, it's not just a customer issue. You know, banks face high turnover rates these days. What are you seeing when it comes to frontline, you know, virtual bankers, frontline reps, whatever term we use, customer support heroes? What what are you seeing when it comes to their experiences as well? Well, in order to get and keep people, you have to make their experience positive. You only can make their experience positive if you're sharing the same insights that you have in the data area with the whole organization. The democratization of data insights has never been more important. I want my teller to have access to what my customers are feeling. And if they call a branch about a problem, I want that person not to have to look for what that challenge may be, the path they took, what challenges they're up against. In addition, I wanna proactively give this information across the organization so I can also drive innovation. I can drive better product development. I can drive better customer service. Because if you give me insight into people that are having problems, I can reach out to that consumer proactively and say, by the way, based on information that we have around what you've been doing with us lately, there seems to be a problem. It may be, for instance, that I continue to get to really low onto my checking account where I've never done that before. And you also realize that I'm making payments, let's say, on my mortgage on the twenty first instead of the fourteenth of the month. Yeah. Well, can my financial institution see that? Yes. Can they also see that my pattern has gone differently? Yes. Well, that may mean there's a challenge. Reach out to me and say, we may be wrong. However, based on your history, you're doing things differently than you did in the past. We talked about before the call the fact that when we talked about TPP and and consumer benefit packages that went out from the government for checks that went out because of the COVID crisis, a lot of organizations got fat and happy going, look at how our savings rates have gone all the way up. Look at all these customers that love us. Very few said, what happened two and three days later as far as transfers? Where did those transfers go? Did they go immediately to pay a mortgage payment that was late, or did they go to Robinhood? That's the difference between somebody that maybe waived payments on a mortgage or on a consumer loan because we were allowed to simply to make it so I can defer and build up a savings. On the other hand, how about those people that took the deferment because they had to? Yeah. Those are different eye aspects. And if you democratize the data across the organization to many people, it's gonna help out. Yeah. Exactly right. You know? And and as you're talking, a lot of these things that that we're mentioning, right, like, how can we simplify the experiences here? Right. I've sort of, we we've organized these as they they flow together on the top and the bottom. You know, what you're talking about on the left, you know, put search boxes in front of people. Often organizations, and financial institution institutions hesitated to do that because we weren't they they weren't the search experts. Everything was being built in house. Well, that's exactly what we do here at Coveo. Right? So the the most intelligent search engine that exists in the marketplace, you know, today, is about putting that in front of people. And then, of course, understanding what people do on the back end. Right. One of our clients, a a large national telecom carrier here in the US, you know, has given us the the this the thing that they learned, which is people don't lie to their search box. Right? So, if you wanna start to understand what people are looking for, well, great. You know, we've got analytics on the back end that help you to see what are the most common queries? What are the ones that don't return results? Where are your content gaps? What are people looking for that they don't find information on? Well, fantastic. Putting search in front of people. And then in the middle, using what you've learned from the first from the left hand side to be proactive, to recommend content to customers because they will be very happy when you give them things they didn't know they needed, but they that they value highly. Right? So, that that's where relevance comes in. The idea of, like, this Netflix type experience where, man, people like you have watched these other things, or here are the hubs that I love at this time of year. Here's the Christmas movie hub. Awesome. It's so simple. I have to go to one place to find all the Christmas movies that I want, and I don't have to go search wait. What was that one my kids watched last year that they really liked? No. It's all right there because you know what I've done in the past, and you're putting information in front of me when I need it. Right? I don't need Christmas movie hub in July. I need it starting December first. Alright? And then, and on the right, informing your people, making sure that your people are on the same page as your customers. There's nothing worse than a a customer knowing information that your frontline rep doesn't have. Was talking to to one of our, you know, large national banks that that we work with here, about what's changed as a result. And they said, you know, our people don't have to Google stuff anymore, and that's really good because for a lot of times, their frontline reps were just on Google. And to to learn the same things the customers were learning, they don't have to do that anymore because every information source that you have becomes indexable and put right into your frontline rep console. You know, it's interesting, Devin. There's a lot of things on that last slide, and every one of them is very, very important. What we have to realize, though, is you don't have to go alone. And I'm gonna do a shameless plug for you guys right here, but this is where partnerships come in handy. If you work with a a firm such as Coveo and you go through and say, I need help in making it so I can go forward with confidence that I can help a consumer proactively and I can be on their customer journey with them, This is where partnerships become invaluable. You cannot go this alone. And if you do, you're gonna end up having the trials and cheap relations. It's like going from point a to point b on a road and not using Google Maps. You can do it. You could probably get there. The challenge is you're not gonna get there sufficiently, because Google's gonna tell you, oh, by the way, you wanna avoid this traffic jam. You wanna take this alternative route. Yeah. You wanna do this on your journey. It's exactly the same thing we're talking about here. And as I said, this goes along the line with almost everything that we're doing as financial institutions today. It's about speed, simplicity, and scalability. The financial institution partners, the solution providers out there are so equipped to be able to get you from point a to point b. And more importantly, at a time of economic scaling back, they can help you say, by the way, we can scale our solution back to make it so that you can get a return on investment the first time you invest so you can invest more in the future. It benefits both sides of the equation. I just I wanna make that sure that people understood that. There's a lot here, but the reality is this is great to know about it, but it's more important to go and do it. And the only way you're gonna be able to do it is with a third party provider. Yeah. I really, really appreciate you saying that because, certainly, we are the experts in this space. Right? There's no one in this, space who knows more about this than Coveo because we've been doing it the longest. And so, you know, it often just starts with the conversation at the end of the day. Like, let let's figure out if our goals are aligned, and and what we can do to your to your point to show you an ROI, that that's going to help you to meet those goals. I know, you know, this trend, we we've talked a bit about, you know, Jim, and I'm gonna kick it right back to you here because we know banks are being disintermediated. What's the biggest risk that banks are going to face as consumers start to, you know, take pieces of their relationship to neobanks as, you know, the idea of millennials being underbanked. It's not that they're underbanked. They're just not using traditional banks. And, you know, customers saying, well, I like these other ones because they're fast. They're easy to set up. I could use this, you know, really simply for one part of my relationship. What's the biggest risk that exists here? Biggest risk is that you don't know what's happening. Yeah. There are very few financial institutions today that truly they look at attrition as being a lost account. Yeah. They don't look at attrition being I have built three more relationships around my services I currently use with you. Look at transfers. Look at where consumers are searching. Use your partners out there to find out what solutions they're looking at throughout the marketplace that are ones that I'm not providing. Respond to what you see. If a consumer tried to open an account and they don't open it, something went wrong. Yeah. Immediately get back to them on the text channel. You know, we we continue to take the easiest route, which is like email or maybe a phone call. I know for one, I I get rid of all no phone calls get through to me unless I know the number because my phone gets rid of them. You can leave a message, but I don't look at messages every day. On the other hand, email, I scan very quickly to see which ones I can get rid of. It's not how many I wanna keep, it's how many I can get rid of. Yeah. Use text to get back to the consumer. Be immediate. Be quick. Track what's happening. I think when we're looking at alternative providers, the biggest risk is we don't know how bad it is. Yeah. Look at yourself. Everybody who's listening to this webinar, look at yourself and answer the question, how many primary financial relations relationships have you closed in the last five years? Yeah. Zero, most likely. How many other financial relationships have you opened from alternative providers in the last two years? Mhmm. Probably is probably more than one hand worth. Yeah. So every one of your customers are doing the same thing. We've gotta cut them off to the past. We've gotta provide better solutions and show that we care about them more, because even the alternative organizations they go to don't always get it right. Exactly. And that that's a perfect segue into this last trend, right, that, that they will only share this data with you if it benefits them. Right? It's about me, myself, and I first these days. We've all become a little more self centered in the world. Right? Because, we know customers expect personalization. They demand personalization, and yet, they are, you know, making an effort customers, are making an effort to share less data. Organizations feel they're not great at personalizing the experience, and very few customers say banks anticipate their needs. Right? So as we're looking at this, you know, we'll we'll talk about some of the the solutions that that exist here, and then then I'll kick it to you, Jim, and then we'll wrap up our time here. But, right, the idea is that how do we turn data into valuable interactions for our customers. Right? Well, you know, first thing is we want to provide a guided experience. Right? So deploying, in a machine learning models that can say, we've studied all of these interactions that customers have had, and it's not about only understanding the last interaction. It's about anticipating and preempting the next one. Right? And so using the these machine learning models to provide that guided experience to get smarter each and every time that a customer logs in. Each and every time that they interact with you, we know more. And when you put that data into, action, right, when you bring it to the forefront and say, hey. We know you've done these things before. Right? To your Amazon example earlier, we're not gonna suggest a pair of shoes. We know you bought a pair of shoes. We're gonna suggest something that else that that is helpful that complements those things. Ah, now I'm having a guided experience. You're keeping me moving forward. But it's not about just all of the data in the world. The the middle one plays on, you know, a framework I always call the cool creepy factor. Right? It's really cool when you know something about me. It's kinda creepy when you cross that line and you know too much about me. Right. So, we are able to provide, vast amounts of personalization with just a couple of data dimensions. Right? Life stage, understanding the last couple of, you know, things that this customer has done with you, understanding what they've seen, that provides you that level of personalization that stays on the cool side of the cool creepy line. And then last one, Jim, before I I come to you, right, to talk about how to provide value that's not just selling a product, but value that helps me to realize, you know, what I've got with you is a great thing. You've gotta get proactive. Right? You've gotta provide prescriptive recommendations for tools and content that's going to increase their financial well-being. Right? Based on what we know about this customer, they have not done x, y, and zed, and we can see they need to, you know, use this budgeting tool because the inputs and outputs, have changed. And so this is something that should help you. Even if you've already done it before, you haven't done it in a few years. Right? Prescriptively and proactively recommending these things to customers, again, based on what you've known about them and how you can start to, you know, put the right information in front of them. So, Jim, when it comes You know, it's as you're discussing that, it really gets down to it only gets creepy if you're not giving me something of value. Yep. So I'm gonna use an example from last week. I was in London. I was very fortunate to be in London last week. In London, there's a very high level of competition between taxis, Uber, and bicycles. You can rent all three of them in some way, shape, shape, or form. How does Uber make my experience better? Number one, they remember where I've been to see if I wanna go back there. So whenever he left the hotel, went out to eat or did some shopping, the first thing that came up on the screen when I said, I want an Uber, they said, do you wanna go back to x, wherever we were at that time? In addition, when we went to another place, it provided us other things we could do in that place. This brought no dollars to Uber. What it made it, it made it so it was better than what the cab experience and taxi experience would be. In addition, when we took the train out of the city and visited some friends, when we came back, the train app actually told us you can hit this train, and it's gonna make stops along the way, or you can get the express to the one right after it. It's gonna be here ten minutes later, but get you there twenty five minutes sooner. Yeah. This is intuitive thinking, but it's saying, we know where you came from. We figure you're probably going back. Here's what we wanna help you with. And all that takes data, applies it, makes my experience simpler. You're showing empathy because you're trying to help me in my journey at a place where I haven't been in three years, four years, and and then provide predictive and prescriptive recommendations that may not have a dollar value initially, but it may just take Uber instead of taking a a taxi then on. Yeah. Exactly right. Right? And it follows along this maturity curve. That that's exactly what you were, talking about. The the simplest things. Right? Like, just with search, give people what they want. Be responsive. Put the right thing in front of them, and then you continue to learn, and then you give them what they need. Right? You start to become prescriptive, and you start to tailor those experiences, you know, using AI powered recommendations based on what everyone else has been searching. And now you're by your second session with that customer, you know exactly what they need to then, you know, being preemptive and personalized what they need next. The thing you didn't know you needed yet. Right? And that's where you're truly starting to optimize, you know, from a individual journey to a relationship journey that you're on with that customer. So with that, I know we're working this a hard time here. Yeah. If you look at the end of this, you know, beyond the personalization one the the level of personalization, I'm gonna keep on pushing this engagement. Yeah. It's going beyond trying to sell something to remember my name and remember where I am. It's how are you gonna get me to engage? Because if you engage with me, I'm more likely to keep doing business with you. Yes. Absolutely. You know, and so that's the the way that we wanna start to think about this. Of course, you know, anyone, interested in this, we'd love to continue that conversation. For anyone listening who wants a recording of this webinar, we're gonna make that available via email, you know, so that you can, log on. You can share this. You can relisten to some of the things that we've talked about here. But, of course, let me end by saying thank you, Jim, for joining us this morning. Thank you to everyone who was, you know, on the line with us, and really look forward to talking to you all again soon. Thanks so much. Have a great day.

Banking expert reveals 4 Financial Service trends that could make – or break – your customer relationships in 2023

Even if you’ve been in business for years, you can’t keep tabs on every subtle trend in the entire Financial Services industry

The thing is… being “out of the loop” like this will lose you a ton of customers. Why? Because these trends show that customers are increasingly taking a digital-first approach to their finances – and most financial institutions aren’t.

That’s why Jim Marous’s insights will be so crucial for you. Instead of hiring an expensive, time-wasting team of consultants and analysts, you can invest just 30 minutes to learn how to meet your customers where they really are – even if you’re worried that your institution has fallen behind digitally.

- Trend 1: Your customers are more willing to share data than you think... we'll share how you can turn your data into customer engagement

- Trend 2: Customers reward simplicity... see why your humble search box is the key to creating lifetime customer loyalty

- Trend 3: The value banks provide is waning... see how you can become the main institution customers build their lives around

- Trend 4: Digital is now the hub of customers financial lives... see how you can build trust in this critical set of channels

Make every experience relevant with Coveo

Hey 👋! Any questions? I can have a teammate jump in on chat right now!