Coveo pour les services financiers

Faites l'expérience d'une IA sécurisée pour l'entreprise: personnalisée, proactive et puissante.

Les FSI qui utilisent Coveo AI rapportent :

- 76 % de réussite en libre-service...

- -56% de temps moyen de résolution...

- +37% d'augmentation de la satisfaction des clients...

- +231K heures de productivité économisées

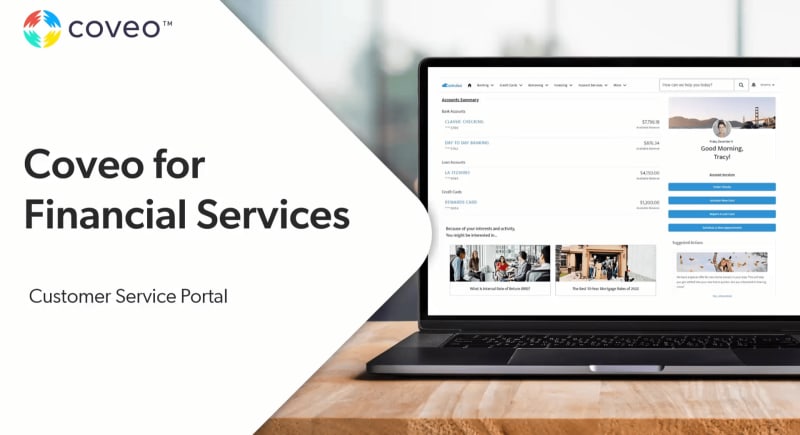

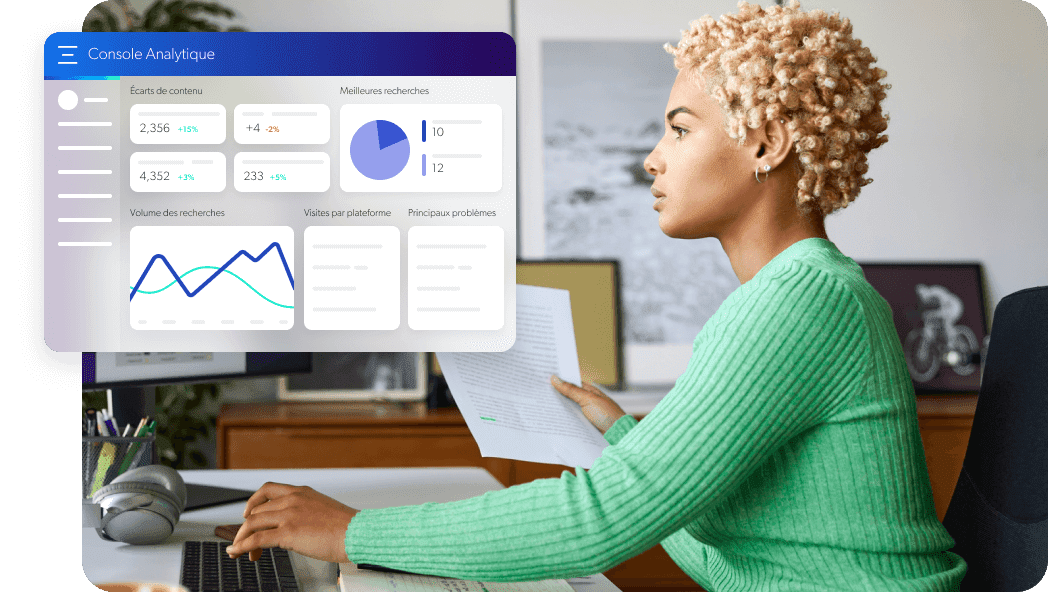

The Caveo Relevance Cloud for financial services enables service leaders to deliver a unified and personalized experience in any channel, deepening customer engagement while improving cost efficiency. Let's show you how we help customers self serve beginning in the digital banking portal. Our industry leading AI dynamically presents personalized content by analyzing all customer interactions, evaluating needs against personal preferences, and creates a proactive and predictive experience. Customers see relevant information before even asking based on the dimensions contained in your system of record. That predictability is extended to respond to customer stated needs using intelligent query suggestions going far beyond the capabilities of simple and outdated type ahead models. Caveo also generates impactful recommendations beyond the stated search query. By examining digital intersections of commonality, we deliver relevant content that can serve impactful business outcomes, outcomes such as next issue avoidance. Further personalizing the experience, dynamic navigational elements allow users to filter content on the fly and narrow results to their preferences. But customers don't always search. Leaders must proactively deliver content within digital processes to improve experience and increase containment. Take this example of providing supplemental information around a lost or stolen card. Preempting unstated customer questions avoids likely repeat contacts. Throughout the entire digital journey, Kaveo AI is tracking customer behaviors, feeding the machine learning models to continuously improve performance while simultaneously creating actionable reporting, which can be used across the entire organization. Kaveo's capabilities can also be integrated directly into the rep's desktop, enabling faster upscaling and allowing them to focus on the customer. Kaveo virtually aggregates content from any repository into a single side by side console, removing the largest source of reps frustration and assisted contact inefficiency, time spent searching for information. Using our contextual recommendations, they automatically see the most relevant resources based on the customer's intent and what's worked for other reps in similar situations. Further enabling productivity, actions can be performed directly within the workspace such as linking the document to the case, posting to a chat feed, and instant email follow-up. Kaveo also creates a true three sixty degree experience showing reps a snapshot of that customer's previous online experiences, so reps know what actions customers have already taken and can avoid making the repeat information. As assisted contacts often go beyond stated intent, CSRs need to actively search for information. Say a customer asked for a financial advisor recommendation. Caveo reduces search time with dynamic faceting such as advisor specialties or the user's location. Of course, this is customized by any contextual information stored in any of your various systems. By having all the information needed in a single intelligent location, reps effortlessly become proficient in less time while experiencing less frustration. Caveo, providing relevance to every interaction.

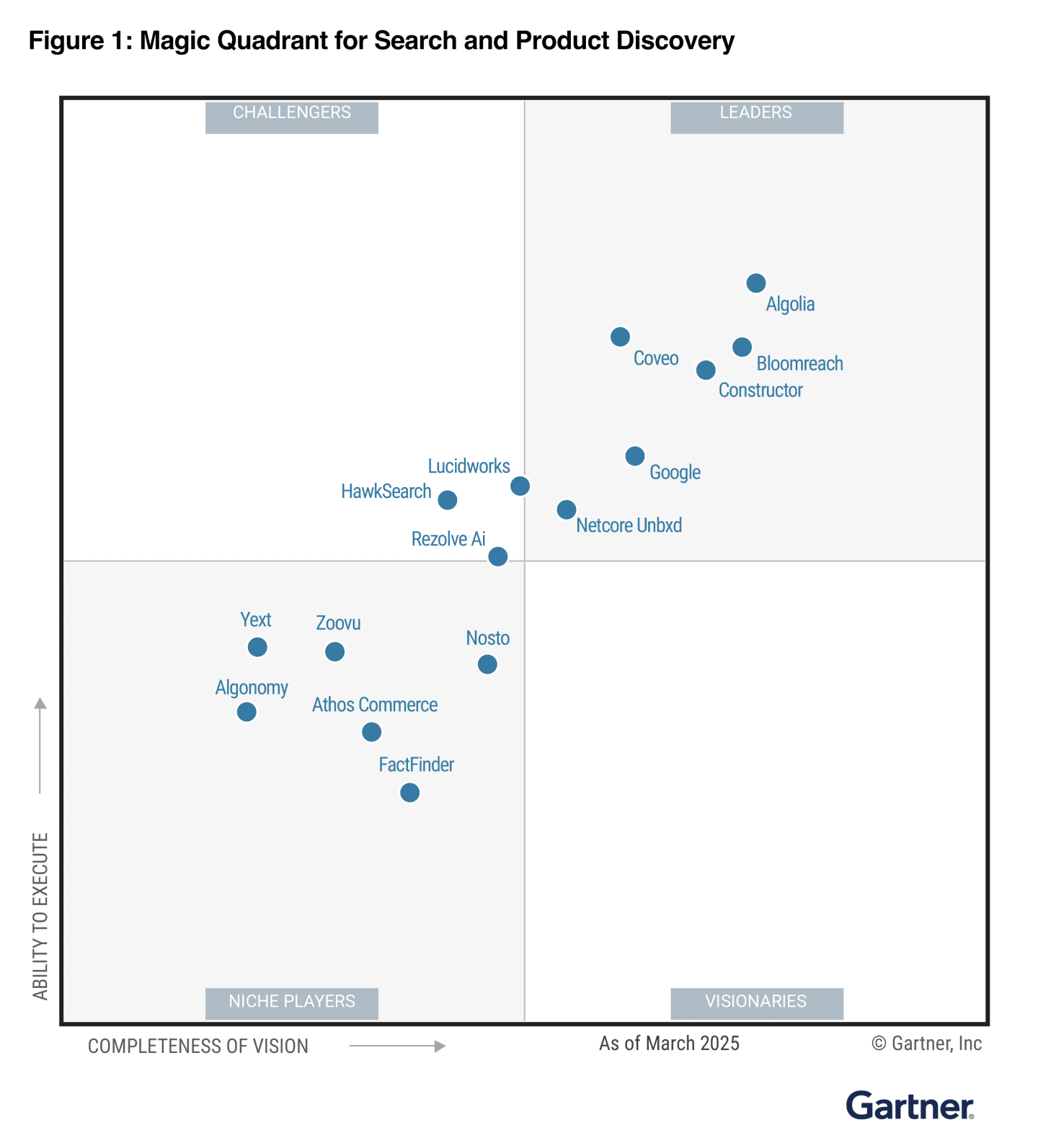

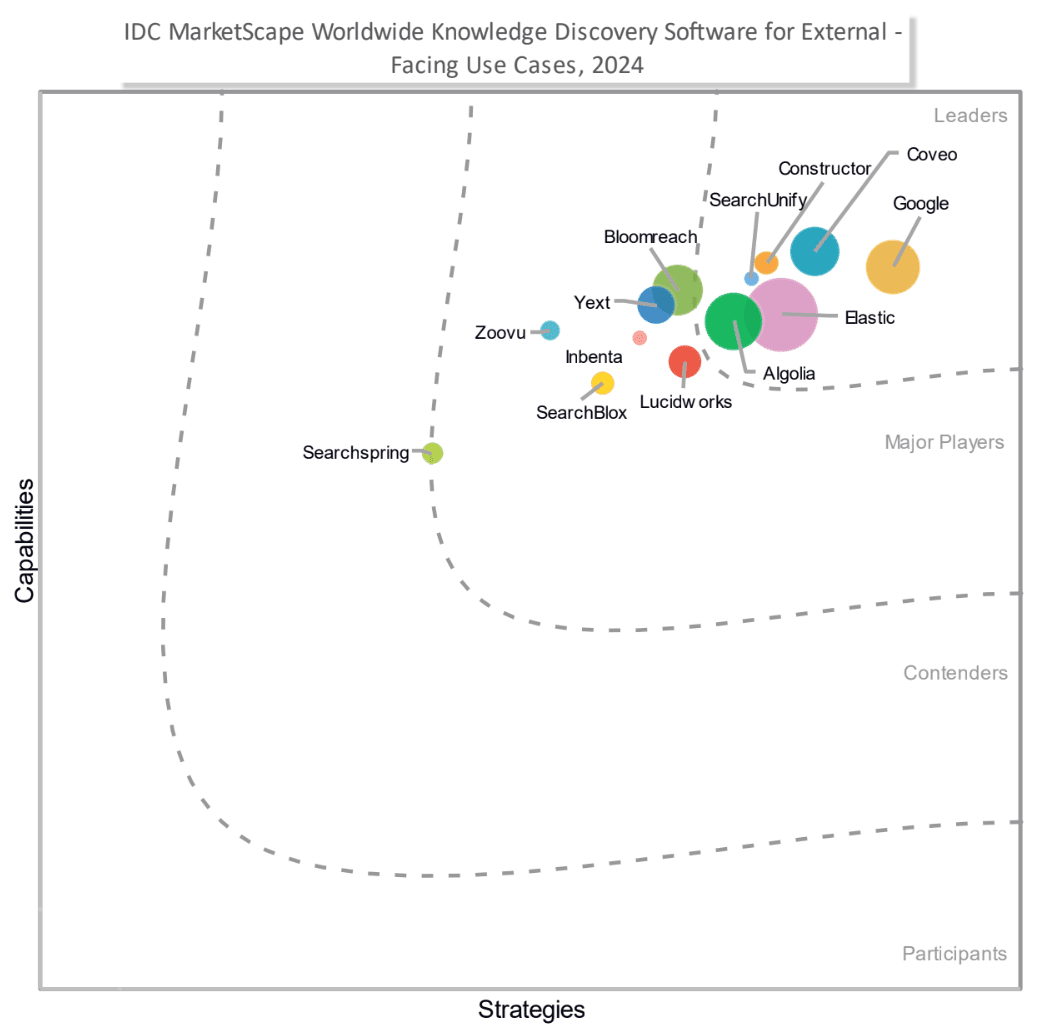

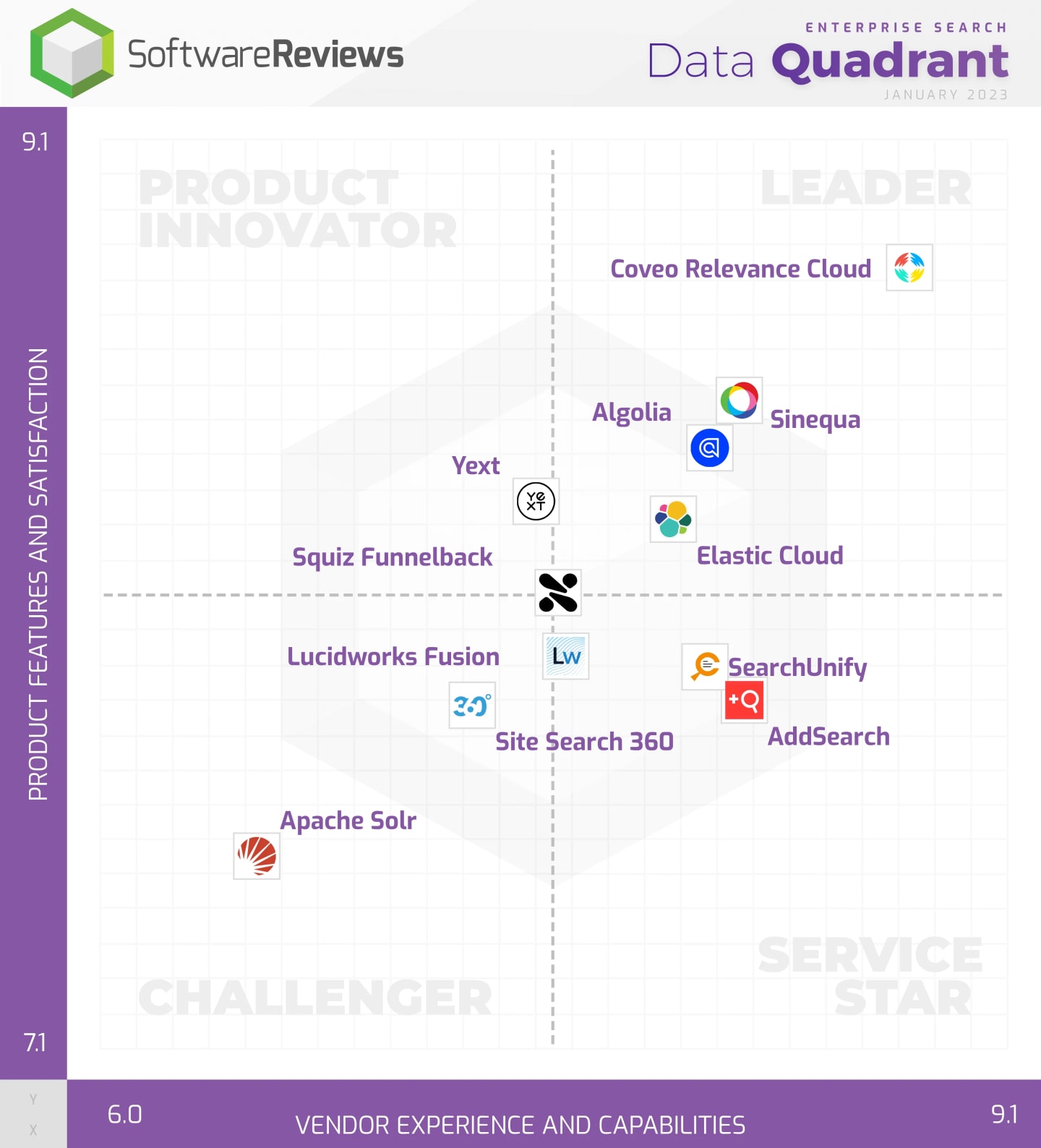

Les analystes sont d'accord,

Coveo est en tête

Permettre une innovation sécurisée pour les services financiers

Permettre des interactions personnalisées et des opérations rationalisées

- Accroître la satisfaction: Fournir des conseils et un soutien financiers personnalisés

- Augmenter l'efficacité: Donner aux clients les moyens d'agir grâce à des options en libre-service

- Augmenterles revenus: Identifier les opportunités de vente croisée et de vente incitative

Améliorer la satisfaction et l'engagement des clients :

- Un engagement numérique plus important: Veillez à ce que vos clients reçoivent des informations personnalisées en fonction de leurs objectifs d'investissement et de leurs avoirs.

- Desconseillers soutenus: Offrez aux conseillers de puissants outils d'IA pour qu'ils puissent passer du temps à aider leurs clients, et non à chercher des informations.

- Réduire les risques: Utilisez l'analyse de l'IA pour améliorer la gestion des risques et la conformité.

Donner des conseils personnalisés aux clients les plus exigeants

- Stratégies personnalisées: Fournir des recommandations d'investissement sur mesure

- Améliorer l'efficacité: Équiper les conseillers d'outils d'IA pour améliorer la productivité.

- Améliorer la fidélisation: Offrir des conseils proactifs et personnalisés pour une satisfaction à long terme.

Coveo AI réduit les coûts tout en améliorant le CX pour les banques de détail

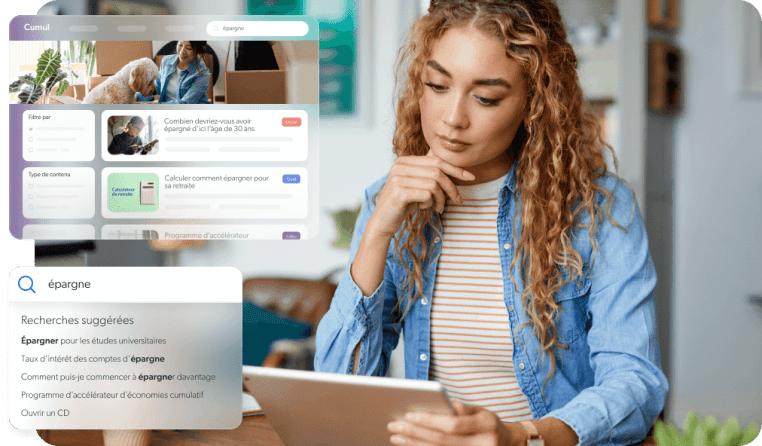

CX numérique pertinent de bout en bout

CX numérique pertinent de bout en bout

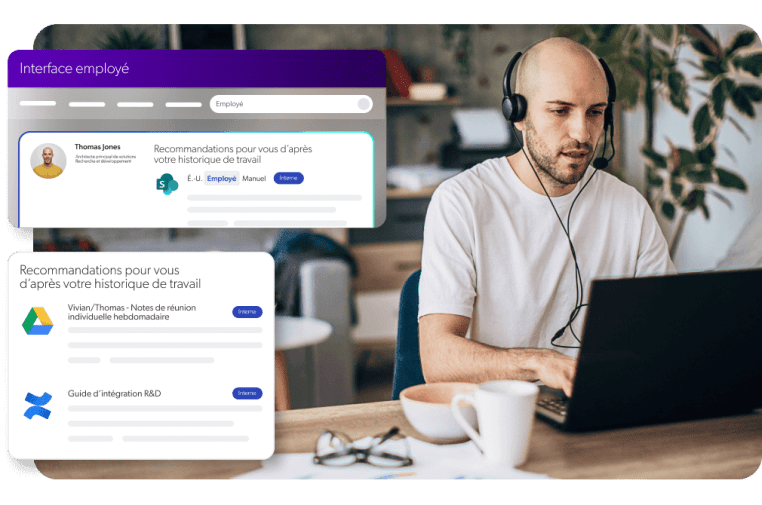

Expériences personnalisées pour les employés

Expériences personnalisées pour les employés

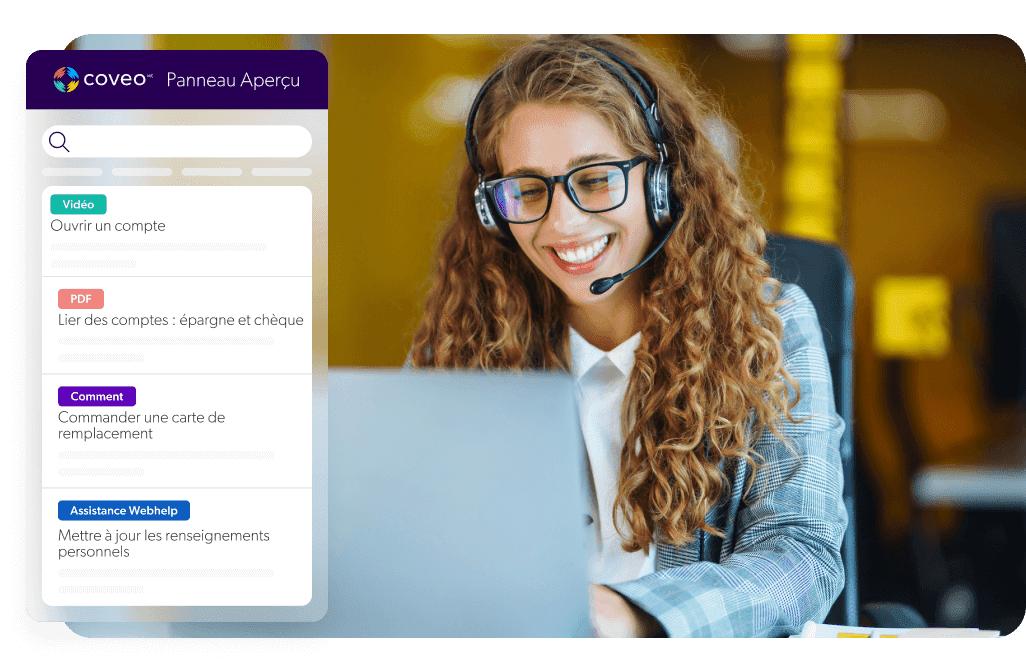

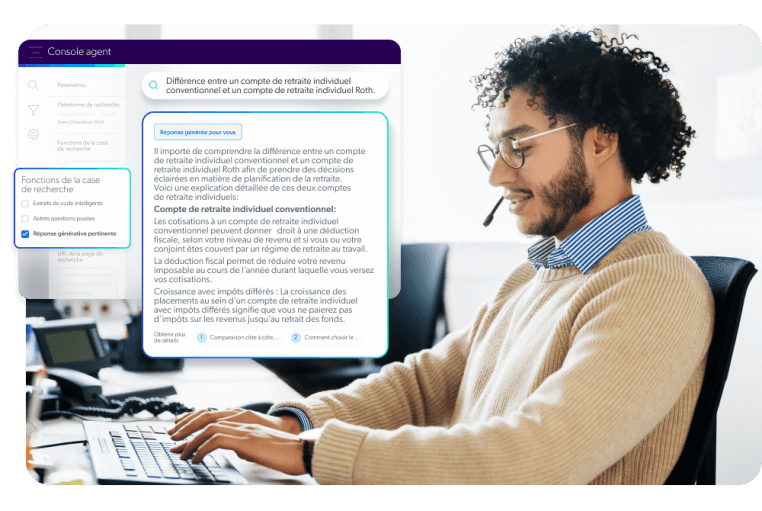

Responsabiliser les représentants des centres de contact

Responsabiliser les représentants des centres de contact

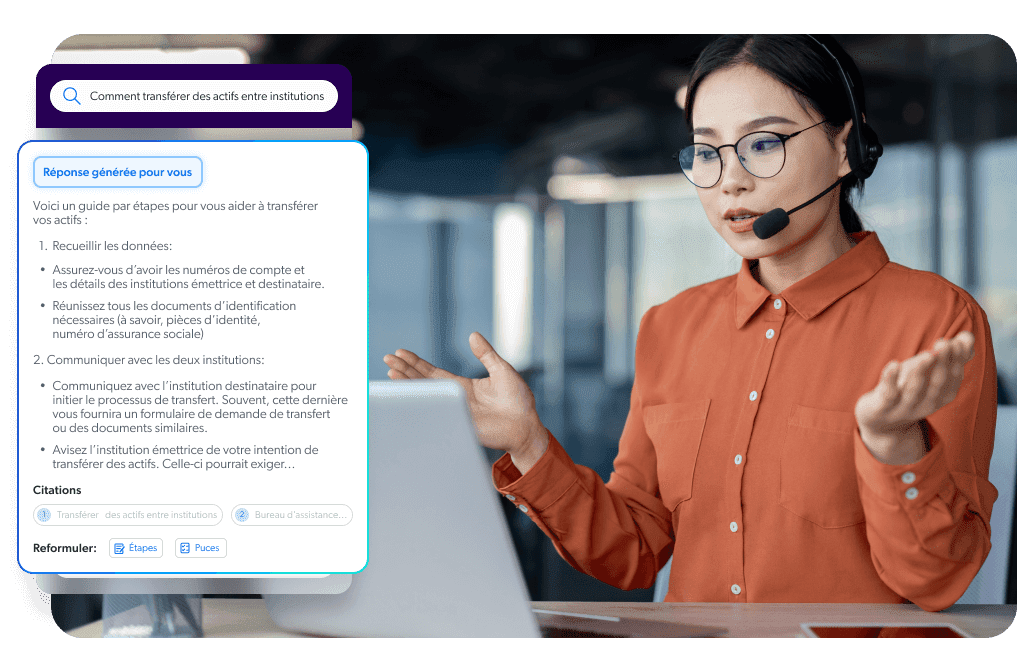

Réponses génératives pertinentes de Coveo

(Coveo Relevance Generative Answering)

Réponses génératives pertinentes de Coveo

(Coveo Relevance Generative Answering)

So this demo is built on top of an index of Coveo technical documentation, created knowledge, forums, and YouTube in YouTube videos among other things. So I will go to search box and I will first type what are the different ways to build a search interface. So while the answer is rendering please note the rich formatting here so we have clear headers, nice spacing between paragraphs, and we now have tables providing an elegant way to render information to users. If we scroll down we have citations to the documents for which the answer is generated. We can see an excerpt before clicking to open the original content. We now have also the possibility to enter into a conversation with a search engine. So we have an ask follow-up search box here and we also have suggested queries here that are automatically generated. Of course at the bottom we have great search results ranked by relevance. So I will ask a follow-up to the Coveo the original question. Remember, the original question was, what are the different ways to build search interface? So let's say that I will type using Atomic, which is one method to build search interface with Corel. So if I type using atomic here, it will generate a new answer with the con in the context of the conversation. And while it's rendering here, it's rendering a nice, a nice list of features and benefits for Talmik here, but it's really a follow-up to the original question here and I can click here to reopen the original question and get the answer here. Right? And I can collapse this and I will get back to the using atomic here. So now let's see what what I had in terms of suggested questions here. So how does Atomic Library compare to JavaScript search framework in terms of performance and programming skills required. Let's click on this and it's very interesting right from a it will, it will compare from a performance and programming skills perspective how Atomic and JavaScript Search Framework compares with each other. I will type a new search here. I want to show you one last thing. This is pretty cool. How to change the look of Atomic? So while it's rendering the answer, of course, you will see it's rendering quite quick rather quickly. So you will see a nice table here listing all the custom properties in the description that can be used to customize, the styling of Atomic here. But please note the different, styling here in the answer, and we're using a different styling here for code and CSS, CSS here. So in addition to nice paragraphs, headers, tables, and so on, now we can also render code in the answer, which is, quite important, especially in technical documentation, the context of technical documentation. So all of this, is rolled out as we speak to existing customers, all of these great capabilities. They are customizable and can be adapted to any size layout. So we're quite excited about the outlook of this and the impact of this on user experience, and, we look forward, testing that with you in the future.

Les organisations qui utilisent Coveo rapportent...

Coveo s'intègre parfaitement dans votre stack technologique existant

Commencer à utiliser l'IA sécurisée par l'entreprise et conçue pour les FSI