Coveo pour les services financiers

Faites l'expérience d'une IA sécurisée pour l'entreprise: personnalisée, proactive et puissante.

Les FSI qui utilisent Coveo AI rapportent :

- 76 % de réussite en libre-service...

- -56% de temps moyen de résolution...

- +37% d'augmentation de la satisfaction des clients...

- +231K heures de productivité économisées

Les analystes sont d'accord - Coveo est en tête

Cas d'utilisation

Permettre une innovation sécurisée pour les services financiers

Banque de détail

Gestion des investissements

Gestion de patrimoine

Banque de détail

Permettre des interactions personnalisées et des opérations rationalisées

- Accroître la satisfaction: Fournir des conseils et un soutien financiers personnalisés

- Augmenter l'efficacité: Donner aux clients les moyens d'agir grâce à des options en libre-service

- Augmenterles revenus: Identifier les opportunités de vente croisée et de vente incitative

Gestion des investissements

Améliorer la satisfaction et l'engagement des clients :

- Un engagement numérique plus important: Veillez à ce que vos clients reçoivent des informations personnalisées en fonction de leurs objectifs d'investissement et de leurs avoirs.

- Desconseillers soutenus: Offrez aux conseillers de puissants outils d'IA pour qu'ils puissent passer du temps à aider leurs clients, et non à chercher des informations.

- Réduire les risques: Utilisez l'analyse de l'IA pour améliorer la gestion des risques et la conformité.

Gestion de patrimoine

Donner des conseils personnalisés aux clients les plus exigeants

- Stratégies personnalisées: Fournir des recommandations d'investissement sur mesure

- Améliorer l'efficacité: Équiper les conseillers d'outils d'IA pour améliorer la productivité.

- Améliorer la fidélisation: Offrir des conseils proactifs et personnalisés pour une satisfaction à long terme.

Coveo AI réduit les coûts tout en améliorant le CX pour les banques de détail

Les clients attendent un parcours personnalisé et connecté

Les clients veulent pouvoir se servir eux-mêmes. S'ils ne peuvent pas le faire, ils n'ont d'autre choix que de se tourner vers des canaux d'assistance coûteux. Donnez-leur les moyens de résoudre leurs propres problèmes à grande échelle, sans dépendre de vos représentants.

Les conseillers financiers méritent mieux

Vos conseillers veulent avoir confiance dans le travail qu'ils accomplissent. Mais les systèmes cloisonnés les épuisent. Ravivez leur passion et retenez leurs talents à long terme.

Les CX et EX sont plus que des "dépenses nécessaires"

Les expériences des clients et des employés ne devraient pas être des coûts. Bien menées, elles deviennent un moteur de confiance, de loyauté et de croissance. Changez le discours et faites de vos expériences des centres de profit.

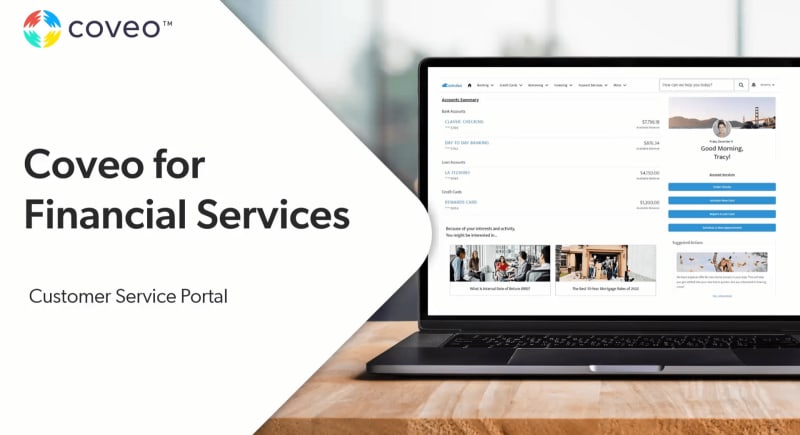

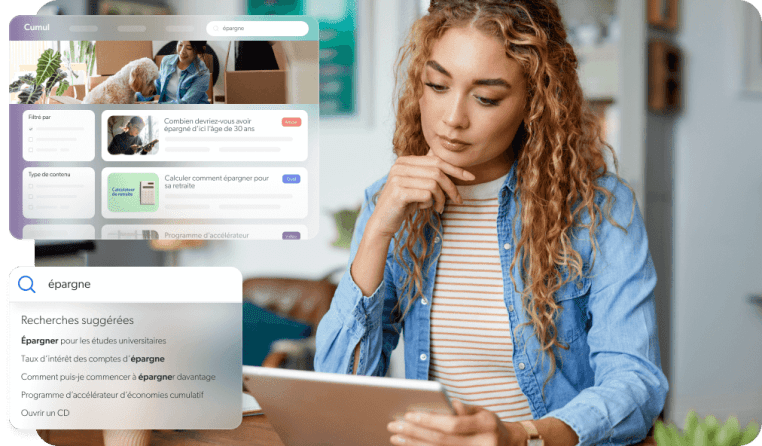

CX numérique pertinent de bout en bout

CX numérique pertinent de bout en bout

Offrez des expériences pertinentes aux visiteurs du site - avant même l'authentification. Augmentez le temps passé sur le site, l'engagement du bien-être financier et les conversions grâce au moteur de recherche et de recommandation auto-optimisant de Coveo AI. Réduisez les frictions grâce aux suggestions de requêtes, à la tolérance aux fautes de frappe et aux classements de résultats basés sur la pertinence.

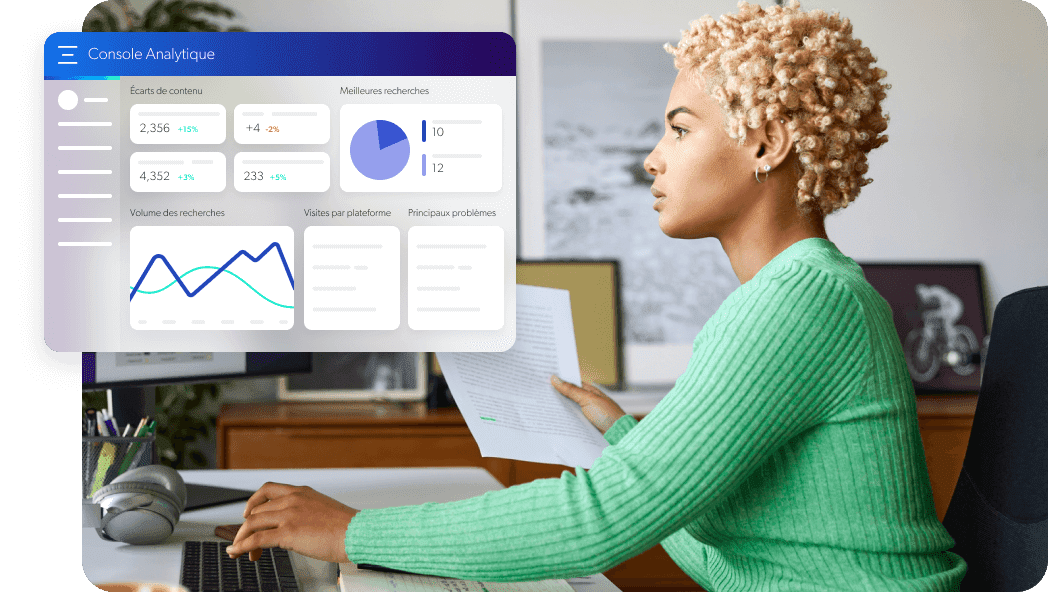

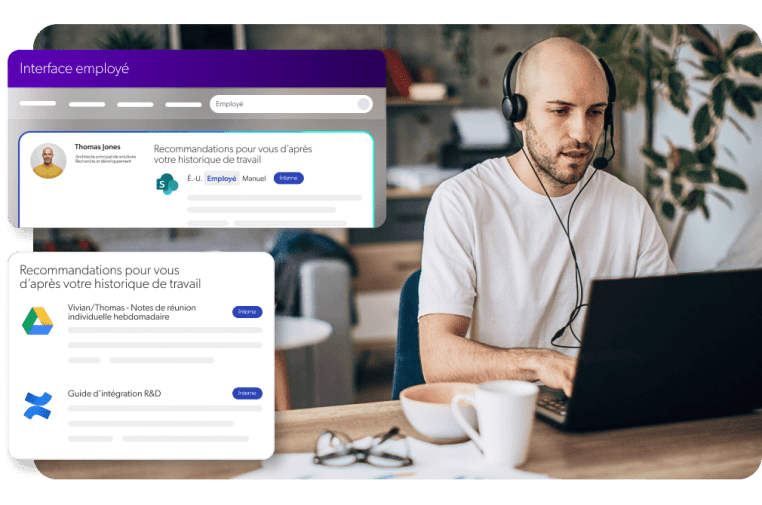

Expériences personnalisées pour les employés

Expériences personnalisées pour les employés

Aidez vos employés et vos conseillers financiers à se servir eux-mêmes à grande échelle avec des recherches intelligentes, des recommandations et une orchestration de parcours. L'apprentissage automatique optimise la valeur que vous obtenez de Coveo en recueillant des données sur les interactions des employés. Les analyses fournissent des insights sur les lacunes en matière de connaissances et les opportunités d'augmenter l'engagement.

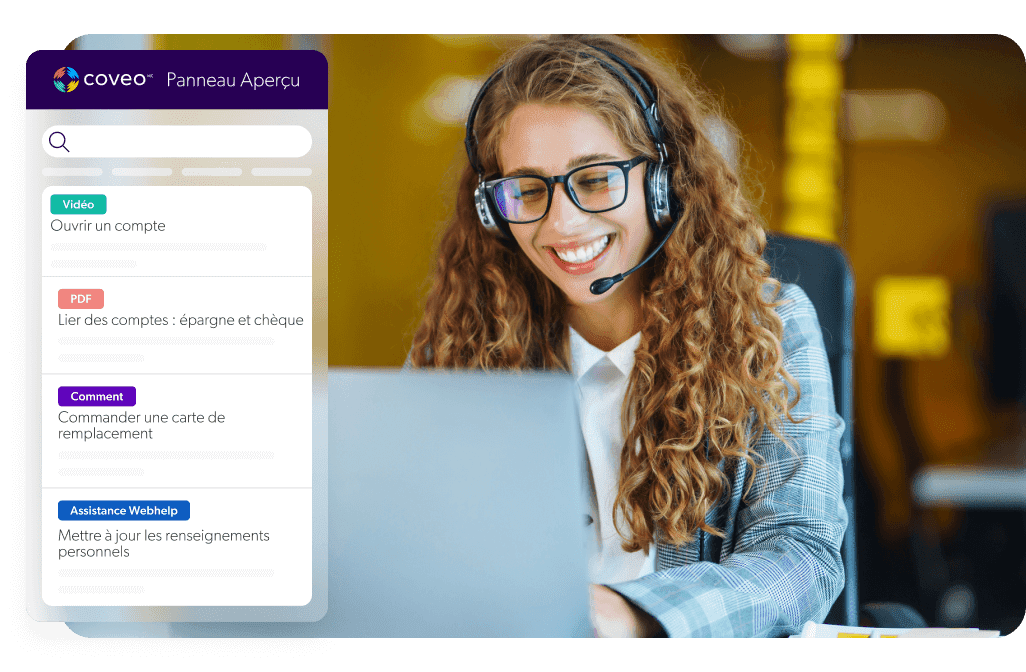

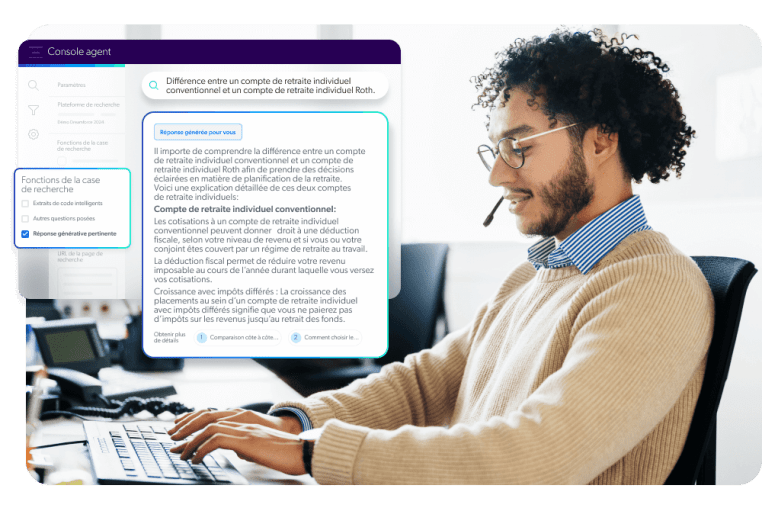

Responsabiliser les représentants des centres de contact

Responsabiliser les représentants des centres de contact

Augmentez l'efficacité et l'engagement des représentants en leur fournissant des informations pertinentes directement dans leur flux de travail. Centralisez les connaissances institutionnelles pour éliminer les silos et augmenter la résolution dès le premier contact. Fournissez des informations à 360 degrés basées sur l'historique du client pour un temps de résolution record.

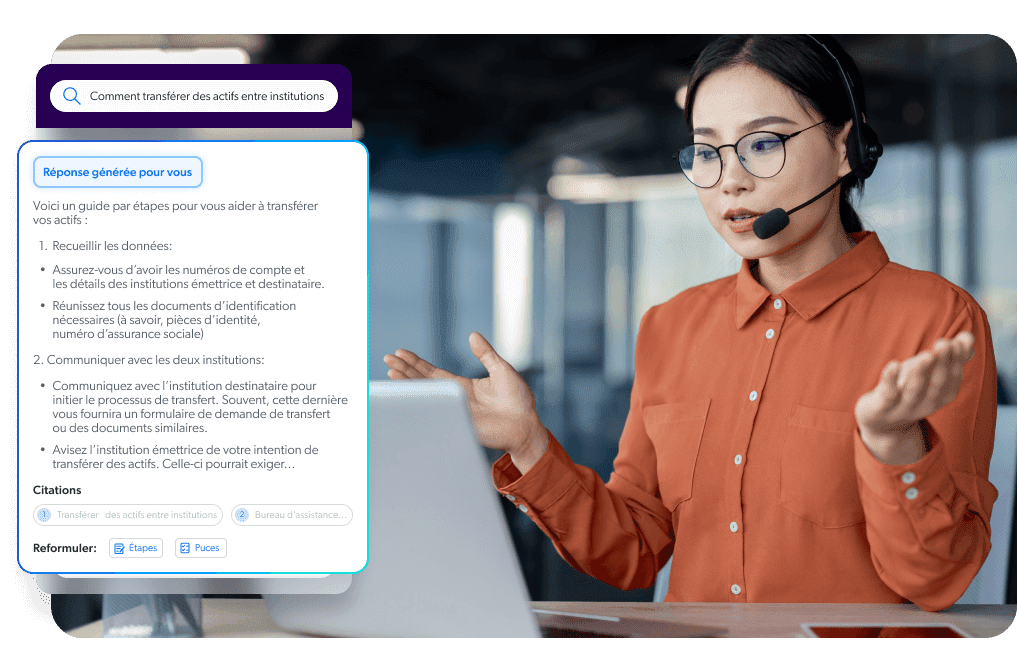

Nouveau

Réponses génératives pertinentes de Coveo

Réponses génératives pertinentes de Coveo

(Coveo Relevance Generative Answering)

Nouveau

Réponses génératives pertinentes de Coveo

Réponses génératives pertinentes de Coveo

(Coveo Relevance Generative Answering)

La première plateforme d'IA de pertinence au monde offrant des réponses génératives prêtes à l'emploi, suffisamment sûres et précises pour les services financiers, parce qu'ils l'utilisent déjà ! Restez à la pointe de l'innovation sans sacrifier la sécurité. Conçue pour donner la priorité à la sécurité des données, à l'exactitude des faits et à la pertinence.

Les organisations qui utilisent Coveo rapportent...

succès du libre-service

temps de résolution

CSAT

Coveo s'intègre parfaitement dans votre stack technologique existant

Contrairement à ses concurrents, la plateforme Coveo peut comprendre, optimiser et personnaliser dans tous les aspects du parcours d’un client, de vos clients à vos employés.

Intégrations

Les 30+ connecteurs natifs et universels de Coveo AI et les intégrations à des centaines de systèmes. Et fournit des lignes directrices pour que vos développeurs puissent créer des connecteurs personnalisés si vous utilisez des systèmes internes.

Sécurité et conformité

Toutes les données partagées avec Coveo sont chiffrées en transit en utilisant TLS 1.2 et au repos avec des paramètres de chiffrement minimum de AES-256. Elles sont également protégées par les normes ISO 27018. Coveo subit régulièrement des audits AICPA SOC 2 Type II pour s'assurer que nos centres de données et nos protocoles internes gardent vos informations confidentielles en sécurité.

Fiabilité et disponibilité

L'infrastructure de recherche de Coveo fonctionne sur plusieurs serveurs AWS à travers le monde - vous n'avez donc jamais à vous soucier des temps d'arrêt ou de la perte d'accès à vos données.

Next

Next

Commencer à utiliser l'IA sécurisée par l'entreprise et conçue pour les FSI