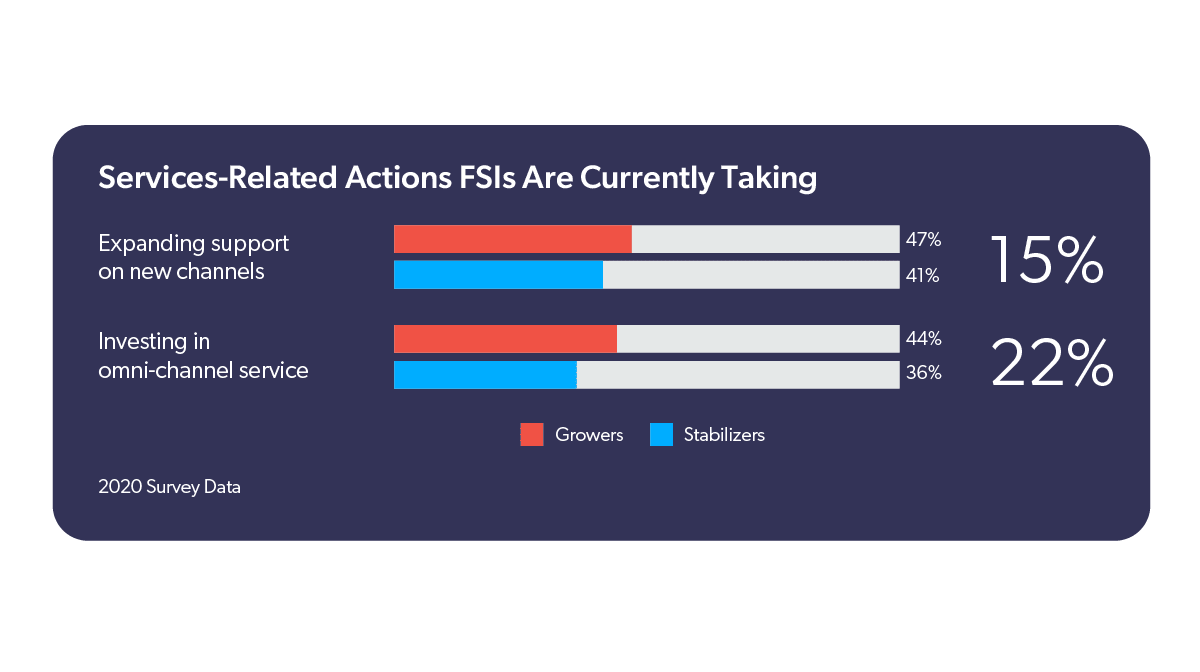

If you can count on one thing, it’s that customer service will only become more important for banking and financial services organizations. For growth-oriented companies, at least. Research from Salesforce found that growth-oriented companies are 22% more likely to invest in omnichannel service.

Which makes perfect sense. We’re talking about people’s money, here. With financial wellbeing on the line, it’s no wonder that the contact center is no longer just a cost center. Leaders in banking and financial services now recognize the contact center for what it can truly be: a place to communicate with bank customers and build relationships.

And a potential profit center, as a result.

Unfortunately, only 27% think the financial services industry is fully customer-centric. Perhaps that’s why Salesforce report found that building and improving customer trust is the #2 business priority for the next two years (right behind implementing new technology).

As to why, findings from our own Service Relevance Report 2022 offer some insight: in a survey of 4,000 consumers in the U.S. and UK, 96% of respondents said they might never buy from a company again after just one negative customer service experience.

So, which trends will shape the future of the contact center in this space?

| Traditionally, a contact center team is responsible for the costs it creates (or helps avoid). Money goes into contact center staff, training, and technology to provide service and support to customers. In banking and financial services, in particular, there’s tremendous opportunity to generate revenue in the contact center — to leverage relationship building, customer insights, and more to recommend new or adjacent products to customers. |

Most might think of customer service as post-purchase issue troubleshooting, but it can really be much more. Customer service agents are brand ambassadors — learn more about how AI can enable them to help grow your business.

Relevant Reading: How AI Enables Your Contact Center to Generate Growth

The Banking Contact Center Trends We’re Tracking in 2024

To elevate the contact center experience, banking and financial services companies will need to address three persistent challenges.

These comprise the top three contact center trends that we’re keeping an eye on. You’ll also see what we’re doing to help banks address these issues.

Trend #1: Optimizing Their Digital Channel Strategy

It’s 2022 and contact centers still struggle with high call volumes for what should be low-touch issues. A bank’s customer should be able to find their account number without calling, for example. Pulling up one’s statements on the mobile app should be a simple process.

And yet, customers call in everyday, over and over, about the very same issues.

This logjam in the contact center’s first tier has a cascading effect that degrades the customer experience and increases contact center costs. Customers are frustrated that they can’t figure out the simplest things. They’re opening costly, time-consuming tickets for the same issues when the corresponding self-service content already exists. Many of those customers go through expensive (read: overqualified) support staff to get the information that should be easy to find on their own.

How Coveo Helps Alleviate Disjointed Customer Experience

Our research shows that 40% of Generation Z alone say they will abandon a brand if they can’t resolve an issue on their own. The problem is, this happens a lot: after reviewing 8,000 customer journeys, Gartner found that though 70% of the customers were using self-service channels, only 9% could completely resolve their issue through self-service.

It’s time to help customers help themselves. Moving forward, banks and financial institutions will need to find a way to reduce call volume by offering a better digital self-service experience. The idea is to give customers a frictionless self-service experience through their channel of choice.

What’s frictionless? Not having to dig for answers they didn’t know existed in the first place. It’s almost like the answer comes to them.

That’s how Coveo does it, leveraging AI that automatically considers a customer’s context (such as location, products owned, and website activity) to propose the most relevant content to resolve their issues, proactively and in the moment of need. That could be the contact form, knowledge base search, or even Salesforce community.

Trend #2: Personalizing Every User Experience

It’s difficult to personalize customer experience without the right data. That’s plain enough. But bringing together the right data from multiple sources, at scale, remains a persistent challenge for companies in banking and financial services.

To meet customer expectations for personalized experiences — especially in the digital banking space — banks will need better visibility into customer journeys to provide a better contact center experience.

What does this look like in practice? Visibility into when the customer last called in, for one, or visited the bank’s support site. What was their last interaction with the bank and what did they do? More importantly, do you have a comprehensive blend of this data from all of your channels?

All of this information should be brought together, analyzed, and used to extract the right insights for the contact center.

How Coveo Helps Unify Customer Journey Insights

For many banks, the problem isn’t collecting the data; it’s leveraging the data they already have. There is a solution. For instance, Coveo partnered with the best for analytics (Tableau dashboarding and Snowflake data warehousing, specifically) to offer robust omnichannel analytics for one of our customers.

Today, that customer enjoys a 360-degree view of the customer, which makes it far easier to measure success and optimize the content experience across channels.

What’s more, they can:

- View real time information with little to no manual intervention

- Increase engagement and success across support channels

- Extend timely, relevant content to key touchpoints in the customer journey

Trend #3: Improving the Experience Retain and Engage Distributed Workforces for Quality Customer Service Interactions

If banks want any chance of meeting consumer expectations, they’ll have to take care of their contact center employees better.

Call center employees (customer service reps, or CSRs) require a significant level of training, regardless of experience. Due to physically distributed teams, which is much more prevalent now, training can be difficult and expensive.

Burnout and turnover remain the bane of many a contact center professional.

What’s more, CSRs have to work within multiple tools and interfaces. They often struggle to find the information they need to resolve customer issues, or to make appropriate cross-sell recommendations. It’s not that banks don’t train their CSRs — it’s that they don’t do it effectively and efficiently.

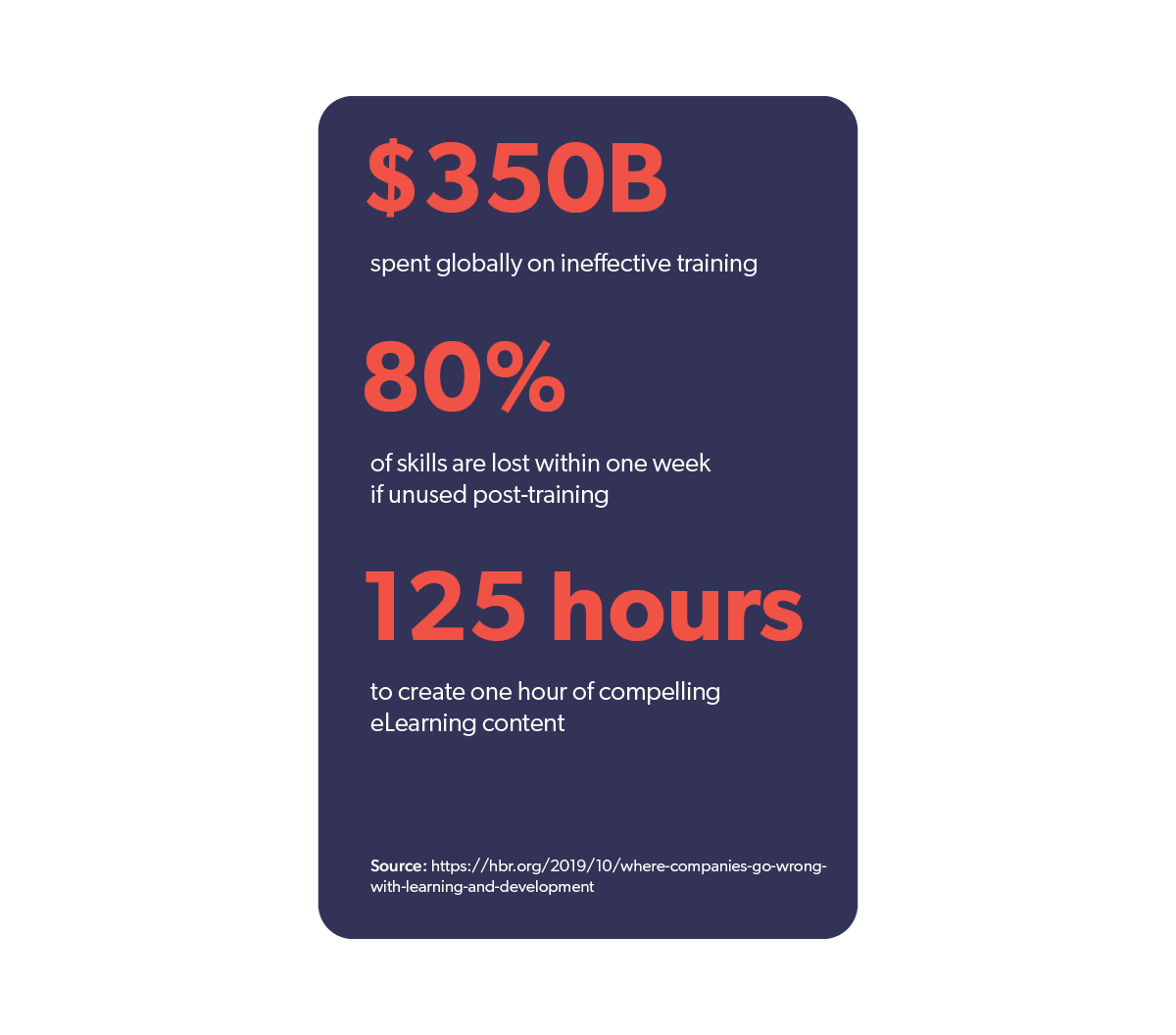

Consider this research from Finastra:

- Globally, companies spend $350B on ineffective training

- Employees lose 80% of skills within a week if they don’t use them post-training

- It takes an estimated 125 hours to create just one hour of compelling training content

We need to find a way to train and support our CSRs a lot better.

How Coveo Supports Employee Training and Retention

Just like customers need personalized content that comes to them, so do CSRs. The trick is to not only integrate enterprise-wide knowledge and training info into the flow of contact center work, but to personalize those content experiences.

With features like insight panels and user actions, Coveo can surface the most relevant and up-to-date information an agent needs for resolving client issues based on a variety of data points. Without switching windows, CSRs will see personalized recommendations based on their role, as well any available customer data (behavior, history, etc.).

Training content can be similarly personalized for CSRs. Here’s what that might look like:

- Layer AI-powered search and information discovery into your workplace apps, intranet, and other important systems

- Centralize and personalize access to knowledge resources from various repositories and for each department and role

- Surface relevant search results and proactive recommendations for new learning

- Deliver actionable knowledge to wherever employees are training

As the aforementioned report from Finastra puts it, “The goal is to make learning and development available anytime, anywhere, via any device.”

Is Your Contact Center Ready for These Trends?

Let’s recap some of the more salient takeaways in this blog post.

First and foremost, the contact center is much more than a cost center. Moving forward, growth-oriented companies will realize and act on the huge potential to drive profits and growth through the contact center. They’ll do so by making the contact center part of their digital transformation — by building customer relationships within that channel and, by extension, upselling and cross selling.

To achieve those ends, contact centers will need to address three core trends:

- Elevation and personalization of digital self-service for banking customers

- Unification of customer journey insights

- Need for a new approach to training and support for CSRs

Finally, AI-powered search promises to play an integral role in the contact center. According to Salesforce, almost 90% of financial leaders think autonomous finance will be a “strong competitive advantage.”

I submit that AI-powered search is one of the financial services trends to keep an eye out for. It’s going to play a central role in making autonomous finance the best it can be.

Dig Deeper

AI-powered search can extend beyond the contact center; learn more about connecting digital experiences in our ebook, Blueprint for Personalized Digital Experiences in Banking and Wealth Management.

As a leader in applied AI, we help financial institutions accelerate their digital transformations while prioritizing customer satisfaction. By harnessing the power of AI-based personalization, you can deliver the most relevant information, advice, offers and products. All tailored to each client.