The financial services industry has seen a somewhat chaotic last four years. While spending is still high, the ways consumers buy — and the concerns they have for the future — have changed significantly.

Still, experts predict things could even out this year, with Fed interest rates staying still and consumer goods (hopefully) taking a break from their explosive price increases from the pandemic.

Here’s what we can expect this year in financial services:

6 Financial Services Trends to Dictate the Future of the Industry

1. Unchecked AI will be reigned in

Companies are continuing to employ generative AI to do more of their more mundane tasks. The financial services industry, while somewhat more cautious in how they use it, is nonetheless using it, at least on an employee level. (See our deep dive on how and why AI in the workplace can be a good thing.)

But banks and lenders answer to a higher authority, and financial regulatory bodies (as well as the Biden administration) have already expressed their concerns about using AI to handle financial matters. Lawmakers continue to go back and forth on how AI security threats should be addressed. In the meantime, we foresee banks testing AI technology under strict conditions and further limiting employee access to reduce breaches.

Will it work? The odds are low that there won’t be at least some unauthorized AI use; people make mistakes. Whether intentional or not, banks will have to deal with issues like copyright infringement, sharing of customer data with Gen-AI tools, and relying on biased information for business decisions. Whether they can get ahead of it with proactive workplace policies and security measures is yet to be seen.

Expect at least some security risks to be exposed in 2024 and the more forward-thinking financial services to embrace AI in unique ways that actually follow the rules.

2. There’s opportunity in uncertainty

While trust in banks has remained high, rumors of a recession and continued market uncertainty have consumers insecure about their financial future. Rather than ignoring this fact, banks have an opportunity to acknowledge the uncertainty, prepare messaging around it, and offer tools that empower customers to do more with their money.

One way to establish customer needs is to ask. Whether it’s with surveys or day-to-day conversations. Even if there’s no face-to-face opportunity to talk to customers, a lot can be learned from what they say through chat apps and online customer service tickets.

Natural language processing (NLP) technology may prove very useful in this mission, as it often clues customer agents into the fears customers have that they may not say out loud. AI has been very beneficial in picking up on customer issues that aren’t explicitly spelled out, even mitigating case escalation in some cases.

This same technology could provide insight into the anxieties customers have around markets or their retirement plans, which can be used for future programming and educational content.

3. Customer loyalty will waver

Just look at any travel-themed TikTok, and you’ll probably catch the phrase “travel hacking.” The hyper-intense method of getting cheap fares by using credit cards and little-known booking tips has gotten consumers used to the idea of juggling multiple cards for maximum reward.

The same phenomenon has been seen in banking, as well. Whether it’s a $300 promotional bonus for opening a checking account or getting an additional .05% APY for connecting an investment account, consumers have taken advantage of perks and promises to get the most money from their bank accounts. This, tied with the very high Fed rate that has boosted savings and investment account returns, means people will want more free stuff from their banks.

So, what happens when the promos run out, rates fall, or there are no more free offers to sign up for? It’s anyone’s guess, but as consumers try to “hack” bank accounts, we could see them become just as fickle about where they put their money as what plastic they use to book their next Airbnb.

4. Mobile experience isn’t optional

Online banking is here to stay, with more customers using mobile banking apps than any other method (for the fourth year in a row.) In fact, 48% prefer their tablet or smartphone app over hopping online to a desktop site, and part of that may be due to the investment banks have made in mobile functionality.

Everything from depositing a check to making a peer-to-peer payment just works better in an app; some banks have even stopped supporting online check deposits through their desktop site.

While not everyone will opt for digital (9% still visit branches in person), the demand for mobile services will push banks to continue investing in secure ways to bank from anywhere.

Banks that don’t provide a good mobile experience will certainly fall behind the competition.

5. Neobanks continue their reign

“Neobanks,” or tech companies that offer banking services but don’t have branches or offer physical touchpoints beyond ATM usage, have increased in popularity. Stats show that the number of account holders in 2022 was 23.7 million, and this is expected to grow to 34.7 million by 2026.

Neobanks offer many benefits to consumers, including quick account opening processes, often superior mobile banking experiences, and a combination of low fees, higher interest rates, or generous introductory promotional offers.

As consumers move away from the traditional services of check writing or depositing cash, these neobanks give a good tradeoff and will continue to dominate the conversation of “where should I put my money?”

6. Personalization will matter more than ever

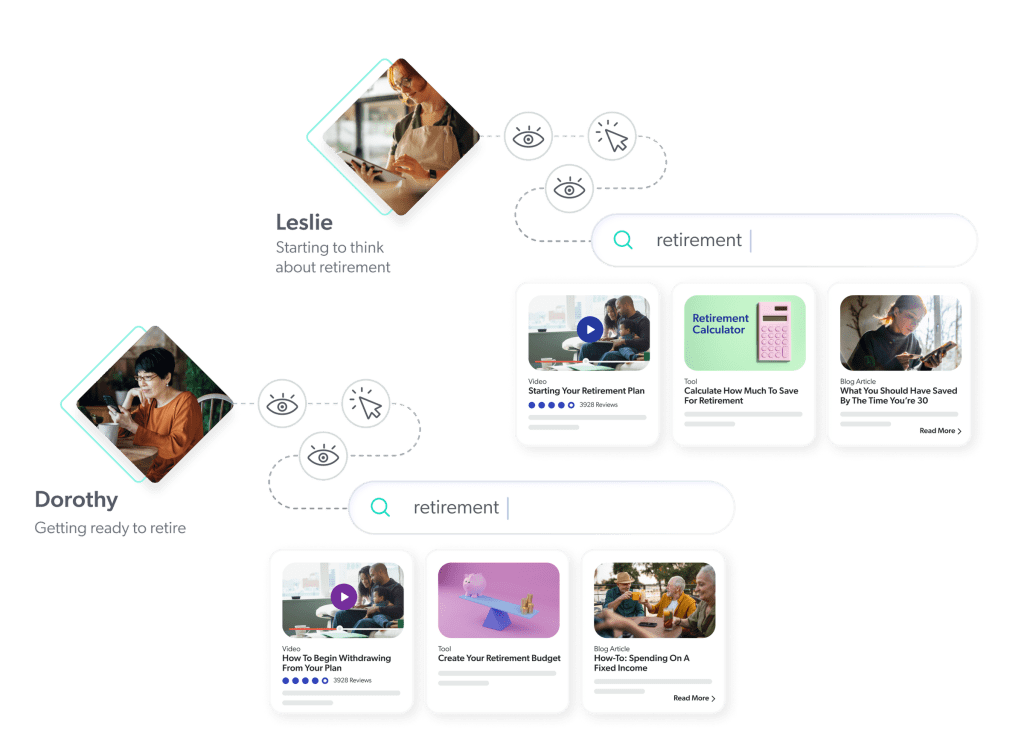

The first five trends point to a hard fact: Banks will need to work harder to gain new customers and keep them for all the financial milestones they meet in life. From funding college to buying a home, consumers expect their financial institutions to offer a personalized experience, not only for their unique stage but for their unique preferences.

Personalization was a major theme for 2023, and we expect the trend to become even more granular. Customers are still willing to give up some level of privacy to get access to customized shopping experiences, and this translates to how they bank.

Examples of how customers share data for better banking include giving up access to credit reports for tools that help them raise their FICO scores and show them relevant card offers.

They may also turn to AI-based investing which relies not only on market performance but each individual’s unique risk performance.

Mortgage pre-approvals, 529 college accounts, and even health savings plans can all work better when they are tailored to the customer. When banks harness this capability to serve customers better, they should see a higher satisfaction rate and customers that stick around longer. We may actually see the end of bank hopping as consumers opt to bundle services with the same bank for their entire lifetime.

Dig Deeper

What’s the main thread running through any digital experience? Search. It’s where most of us start when we land on a website. But there’s a discrepancy between knowing this and executing on what’s needed.

How do you support individual financial service journeys at scale? With AI. Get your copy of our expert-backed report today.