Customers expect their banking experiences to be safe, easy, and personalized. And if they aren’t, those customers yeet for another company.

Traditionally, financial services institutions relied on the perceived difficulty of switching from one provider to another. This bolstered their product stickiness and protected against customer attrition. However, in Salesforce’s 2022 report, “The Future of Financial Services”, found that 22% of banking, 33% of wealth management and 33% of insurance clients have switched providers in the last 12 months.

This is significant given that industry pundits estimate banking customer acquisition costs at more than $300. Accenture says the same, finding the annual churn rates on new customers are in the 20-25% range during the first year — half of which don’t make it past the first 90 days after opening their accounts.

“However, the experts we interviewed agree that churn, by itself, doesn’t provide enough information about where the experience is lagging,” said Salesforce.

Financial services institutions (FSIs) should look at account activity, among other indicators to see if those indicate accounts that are in trouble.

But there is one place where financial institutions can start seeing an immediate impact.

How Do You Rank Your Digital Customer Experience?

Improving the customer experience may have an immediate impact on customer satisfaction.

That might be accomplished through straightforward action, such as having 24/7 customer service, according to a survey by BAI. This can be offered via your website — the new front door of your business — through the self-service demanded by all audiences today, according to Gartner.

Yet customers increasingly want more – with truly personalized experiences that make life easier for them. And they’re willing to share their personal data to make that happen, as long as they trust their bank to keep it safe.

So how do you provide a customer experience that serves these wildly different demographics with very different needs across multiple channels? By connecting your content repositories in a way that provides answers to those who need them, when they need them, where they need them. This can look like a banking customer searching your website — or it can be a customer service representative (CSR) needing to know what a customer has already queried.

Let’s talk about how AI-powered search for financial service offers a customer-centric approach to retail banking.

AI Helps Banks Achieve Customer Centricity

Artificial intelligence (AI) technology has been an integral part of the human race’s learning and development since the first computer took up rooms upon rooms and could only do basic mathematical equations.

AI models have come a long way since those room-sized computers successfully learned long division. But the basic principle is still the same: use machine learning to take a bit of data and extrapolate relevant information that can be used again in different scenarios with lightning-fast speed.

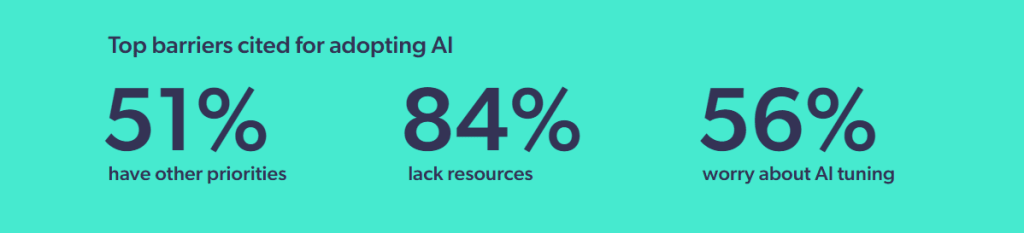

And while much has been written about the need to use automation, bank tech professionals admit they are wary. In Coveo-commissioned research, 84% of surveyed tech professionals who identified as being with FSIs, say they lack the resources to do machine learning — and 56% worry about tuning models.

Digital transformation initiatives, such as strategically implementing AI into use cases like search and personalization, equip traditional banks with the ability to give different digital audiences the information they need. Some customer experience use cases AI-powered search and personalization can impact are:

- Relieving customer service organizations from dealing with escalating case loads.

- Enabling a suddenly-remote workforce to access knowledge in the flow of work.

- Improving fraud detection and reducing losses caused by fraud.

Until 2020, most banks used simple search solutions with manual coding to address content inconsistencies, language ambiguities, and uncertain intent in an attempt to capture customer engagement on digital channels. Banks can use AI to parse customer data and address these challenges efficiently and at scale.

AI uses machine learning (ML) to ascertain and make predictions about future customer needs, based on contextual data. Every time a user performs a search on your website or mobile app, they provide data about what’s useful. ML uses that information to make the next interaction more personalized and relevant, leading to an enhanced customer journey.

So if you’re not using ML, you’re missing out on huge opportunities to cement customer loyalty each and every day.

Here are some scenarios where machine learning could help: did your customer call your contact center after trying to go through a chatbot? That might mean the bot that you pay money to use (sometimes per question) was less helpful than intended. You could fix that with a unified index and AI — not only is more information available to the bot, but AI can sort and surface the correct answer faster.

And if it was a novel question answered at the contact center level, AI-powered Knowledge-Centered Service®* can ensure that the new answer surfaces for the next customer with a similar question.

Do most of your help articles get Google search traffic rather than through-the-app users? That could mean your app — and possibly entire website — isn’t easy to navigate and sources aren’t in intuitive places. AI-powered recommendations and unified search could fix that by identifying what worked before and pull from multiple sources to deliver the right content format (video, an article, or a step-by-step set of instructions).

With ML, all of that information and more can be used to make data-driven predictions and decisions that will meet customer expectations. And in the long run, drives customer loyalty because your customer-centric organization fulfilled those expectations.

Turn Looky-Loos iIto Banking Customers

It almost sounds too good to be true — being able to anticipate customers’ needs before they do — but it really is possible when AI solutions are implemented in a bank or other FSI.

If your institution offers one or more credit cards, providing educational content so consumers find what fits them best is more likely to make them convert — and stay with your firm. What makes your credit card unique? Is it the rewards? What about the low fees and penalties? Perhaps you offer a special deal exclusive to those who’ve been members for a certain amount of time.

Whatever it is, current and future customers need to know — opening the door for AI-based search that can provide those answers.

And the information you collect can extend (somewhat) beyond your owned channels. Before most people request pre-approval for a home loan, they spend hours on real estate websites like Zillow and Redfin. They also shop around to see whether they can get the best deal at a bank or credit union before they ever start giving out their personal information.

By surfacing insights about what information your visitors look for, you can choose wisely when and where to implement targeted advertisements.

Remember, your customers don’t want to dig for the information they want. That information should be easily accessible; that is, in the first place they look, whether that’s on your website or mobile app. Digital tools like AI-powered search puts those answers in front of them in the form of question answering, query suggestions, and recommendations.

In the contact center, that same platform — operating from your unified index — keeps your customer service representatives (CSRs) up-to-date in the event a case can’t be deflected. With features like an insight panel and user actions, CSRs can see what customers have tried before, priming them to handle that call like they’re psychic and avoiding an all-too-common customer pain point; repeating information.

Coveo for Banking Keeps Customer Data Secure

Providing the exact financial experience your customers want and expect is beneficial both in the short-term and long-term loyalty. With AI solutions for the banking industry, you’ll see:

- Increased Customer Satisfaction (CSAT) while reducing costs

- Opportunities to increase revenue

- More customer loyalty

- Reduced loss with better fraud prevention

- More profit

And here at Coveo, we’re ready to jump in now and make that happen for you. The good news is that the behavioral and historical data already exists in your organization. Even if that data is spread across multiple content sources, we’ve got 50+ out-of-the-box connectors to help bring it all together.

Banks are privy to extensive proprietary customer data, and we know as well as you that safeguarding that data has a tangible effect on your business’s reputation. With best-in-class global security standards, customer data is unified in a single Coveo index, which is proprietary and stored on binary files, compressed using proprietary algorithms, and encrypted at rest using AES-256 or better.

But how does it work in practice? Let’s dig into how the combined power of a unified index layered with machine learning delivers greater data security.

Combining Content, Search, and Customer Insights

We start by centralizing the enterprise information your bank has collected throughout its lifetime. Once content is brought into the unified index, it’s categorized to make it searchable.

This categorization happens with metadata, which can include the file name, a meta description — or even content within the file itself.

We can even further enrich the index by applying machine learning in a number of ways:

- Summarization: Summarizes text extracting the most important sentences from documents and uses the output to augment the index.

- Concept Extraction: Identifies the most important concepts of a document.

- Terminology Extraction: Automatically extracts relevant terms from a long query that can be used to find related content.

- Collocation Extraction: Identifies words that frequently occur together.

- Hyperparameter Optimization: Consisting of a mix of local search, simulated annealing and genetic algorithms, this technique is used to optimize/personalize the model parameters for any use case.

But the machine learning possibilities don’t stop there. Once your index is searchable by external users — customers, employees, etc. — machine learning models can process queries to extract attributes that can be used to match that query to relevant content. This helps those audiences securely find answers faster.

Such query-time machine learning techniques include:

- Word sense disambiguation: The user’s context is used to make sense of the query words and understand what the user is looking for.

- Statistical spelling and vocabulary correction: A statistical machine-learning AI algorithm is used to correct erroneous keywords and find good documents based on all users’ search sessions.

- Automatic language detection: Automatically detects the language of each query.

- Question answering: Automatically identifies queries that are questions and answers them directly by extracting relevant sub-sections of documents and returning them to the top of the results.

- Semantic search: Word embeddings-based search that calculates the semantic similarity between queries and content. This determines which content is the most relevant in a given situation and reflects that in the ranking of search results.

- Query suggestions: Based on a user’s actions, content, and one or more letters typed, it suggests query expansions.

It’s a lot, we know. Machine learning is a complex topic, and we’ve only dented the surface. When you have Coveo on your side, you’ll have access to an experienced team who is here to help you every step of the way.

Why Now?

No matter how much, or little, data you have, Coveo is here to help you serve your customers better. With AI-powered personalization to empower your customer-centric approach, you’ll see immediate results because you’ll be putting both people and profits first.

The time is now to make sure your customers see you above all other financial service options. Coveo is excited to help you get you there.

Get a free, 30-minute assessment (a $2,000 value). From banking to wealth management to insurance to investing… our experts have analyzed hundreds of industry-leading enterprises. You’ll get to “pick their brains” and implement artificial intelligence systems that will transform your bank’s offerings and bottom line.

Getting started is as easy as filling in a 1-field form. Within a week, we’ll host your custom assessment and record it so you can pass it around to your team.

The only risk you’re taking is if you don’t contact us.

Dig Deeper

Evaluating enterprise search platforms on the market? Here’s a list of the 10 must-have features in an AI-powered personalization engine for financial service.

Struggling with enterprise search? You aren’t alone. We conducted a study of 100 self-identified financial service tech professionals to find out why — and offer solutions to those obstacles.

*KCS® is a service mark of the Consortium for Service Innovation™