Earlier this season, we published our Holiday Report in partnership with RSR Research, exploring 2023’s Black Friday and Cyber Week trends. But what happens after the wrapping paper comes off and the eggnog is gone?

What will be most important for retailers in 2024? Today we unveil previously unpublished data on what that new year might look like through our survey of 92 U.S.-based retailers, most with revenues above $250M – making them some of the largest in the country. Here’s a data-based glimpse into the upcoming trends, a fast-changing marketplace, and what sets the winners – the companies reporting revenue growth above the average of 7% – apart from the pack.

1. Add to cart: More relevance

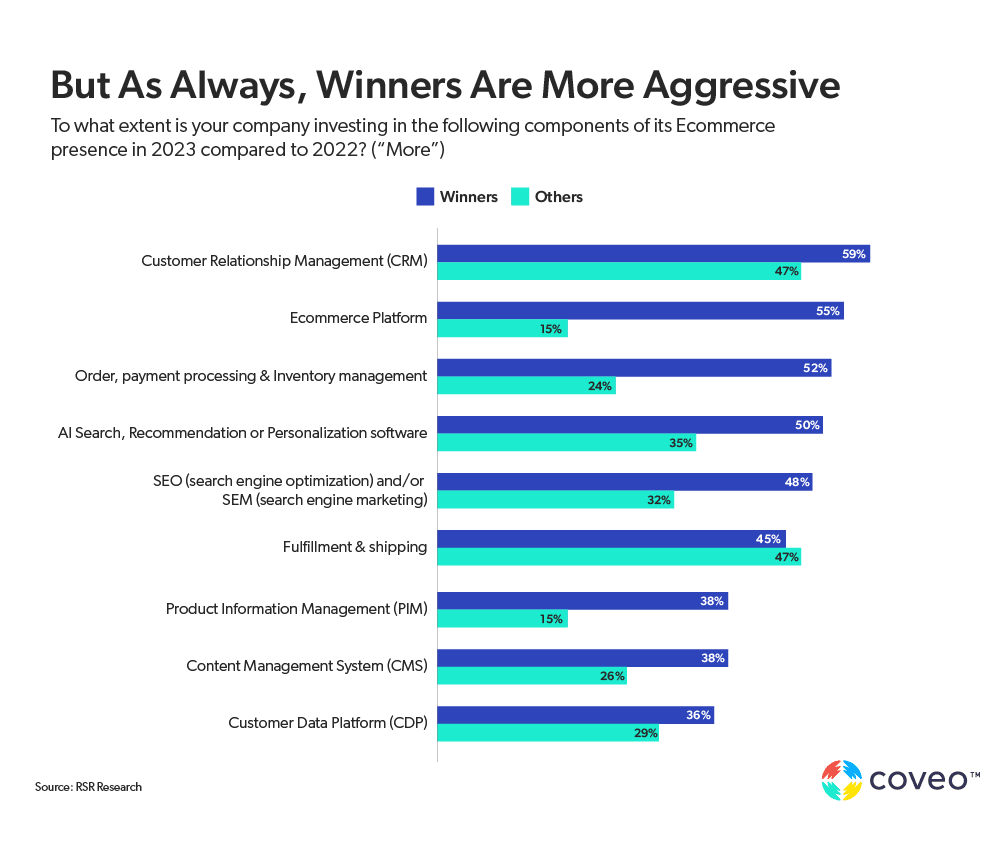

Winners focus on establishing relevance. Between 2022 and 2023, at least 50% or more top performing large retailers said they increased investments in their CRM systems, ecommerce platforms, payment processing and inventory management, and AI and personalization initiatives.

Specifically, top performers targeted these investment priorities:

- 59% invested more in a CRM

- 55% invested more in their ecommerce platform

- 52% invested more in order, payment processing, and inventory management

- 50% invested more in AI search, recommendation, and personalization software

There are big gaps between winning and underperforming retailers in relevance initiatives across the board. Compared with the above, just 15% of underperformers said they were planning to invest more in their ecommerce platform, and only 35% of underperformers set their sights on investing more in AI-powered search, recommendations, and personalization.

Relevance matters to customers

The demand for relevant, personalized results is growing beyond mere preference. Recent research from McKinsey shows 76% of shoppers are more likely to purchase from brands that personalize and 78% are more likely to make repeat purchases.

On the flip side, 71% of customers now expect their experience to feel personalized – and 76% get frustrated when a business makes irrelevant recommendations. Miss the mark and you might miss the sale.

You don’t need to be Amazon or Google sailing on a deep sea of customer info to boost relevance. Online retailers of all sizes can use in-session personalization to pinpoint a customer’s intent and return relevant info in real time.

2. Tackle the guest shopper challenge

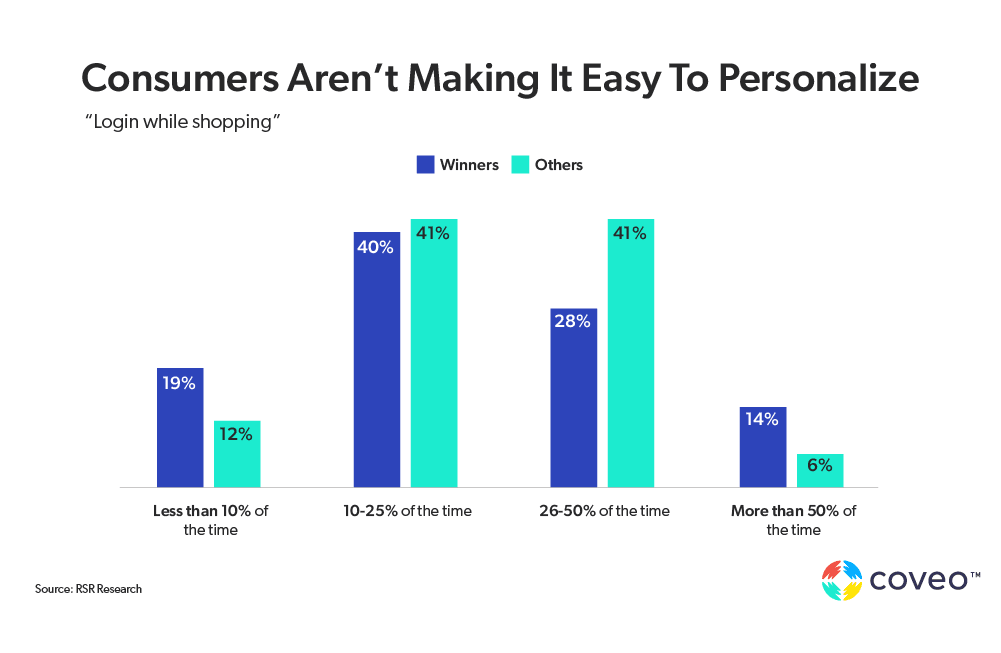

It’s a paradox: shoppers demand personalized experiences, but their habits make that increasingly difficult to deliver. Cold-start shoppers make up 70% of website traffic, and many returning customers simply never log in. Complicating things even more, third-party cookies are fast falling out of favor, too.

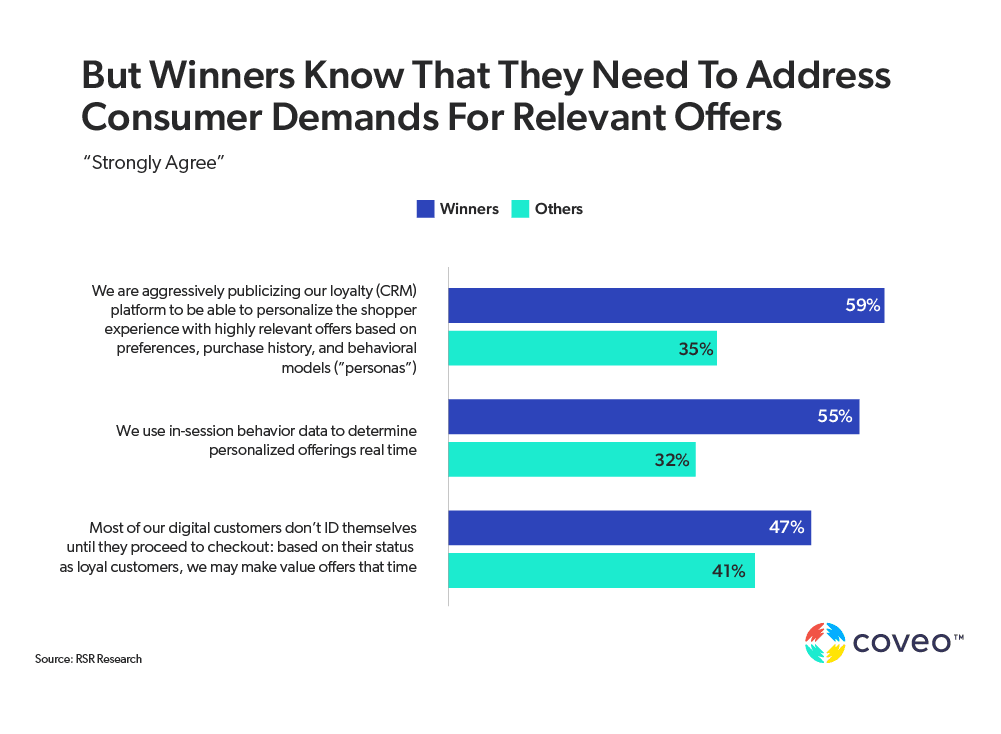

Our winners feel the pressure. They say 59% of shoppers log in just a quarter of the time. It’s a similar story for other retailers, who report 53% of their customers do the same. What sets the winners apart? They know they need personalization strategies to counterbalance all of those guest logins:

- 59% aggressively publicize their loyalty platform to personalize the shopper experience with highly relevant offers based on preferences, purchase history, and behavioral models.

- 55% use in-session behavioral data to make real-time personalized offers.

- 47% make value offers at check-out when shoppers identify themselves as loyal customers.

Providing personalization with little customer data

Historical data can help drive personalization, but retailers can’t rely on logins alone. High-performing retailers know they need real-time in-session behavioral data, too. Powered by machine learning and AI, they can deliver an experience that makes every customer feel special with personalized, relevant recommendations, results, and refinements. Yes, even for those who are visiting you for the first time.

Our own research shows personalized results are more accurate than generic ones by upwards of 30%. All of that can translate to improvements in conversion rates, increases in average ticket size, and a boost in website traffic.

3. Big opportunities for fashion and specialty retailers

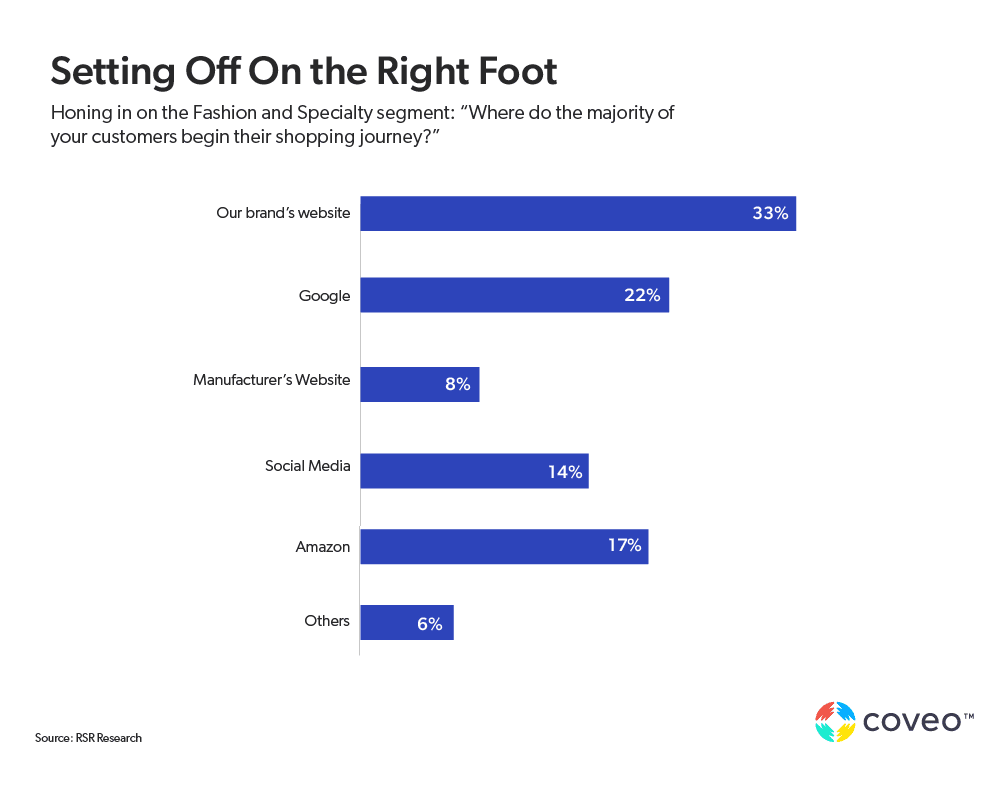

Where do customers begin their shopping journey? For fashion and specialty retailers, 33% of buyers march straight to the brand’s website. That far outpaces customers who begin with Amazon, which accounts for just 17% of those vital first steps.

Here’s how it breaks down in more detail:

- 33% visit a brand’s website first

- 22% start with a Google search

- 8% go directly to a manufacturer’s website

- 14% turn to social media as a first step

- 17% begin on Amazon

With so many shoppers heading to brand websites first, fashion and specialty retailers have an opportunity to start customers on the right foot and wow with a stellar experience through product discovery, relevant offers, and social proof. Impress those buyers early and they won’t need a second step – plus, they’ll remember you next time they shop.

Discover what’s beyond the search query

Product discovery helps customers find items they might want beyond the specific terms they search for. Think of product recommendations on Amazon, which drive 35% of purchases on the platform according to McKinsey. In general, over 60% of shoppers said they purchased something based on a product recommendation from an online store.

What about a complementary purchase that’ll enhance their product experience? Or a simply irresistible impulse purchase at check-out? And don’t forget that holiday on the horizon. Wouldn’t that best-selling item make a perfect gift? Discovery comes in all shapes and sizes, but it’s best done personalized.

4. GenAI is growing (and growing and growing)

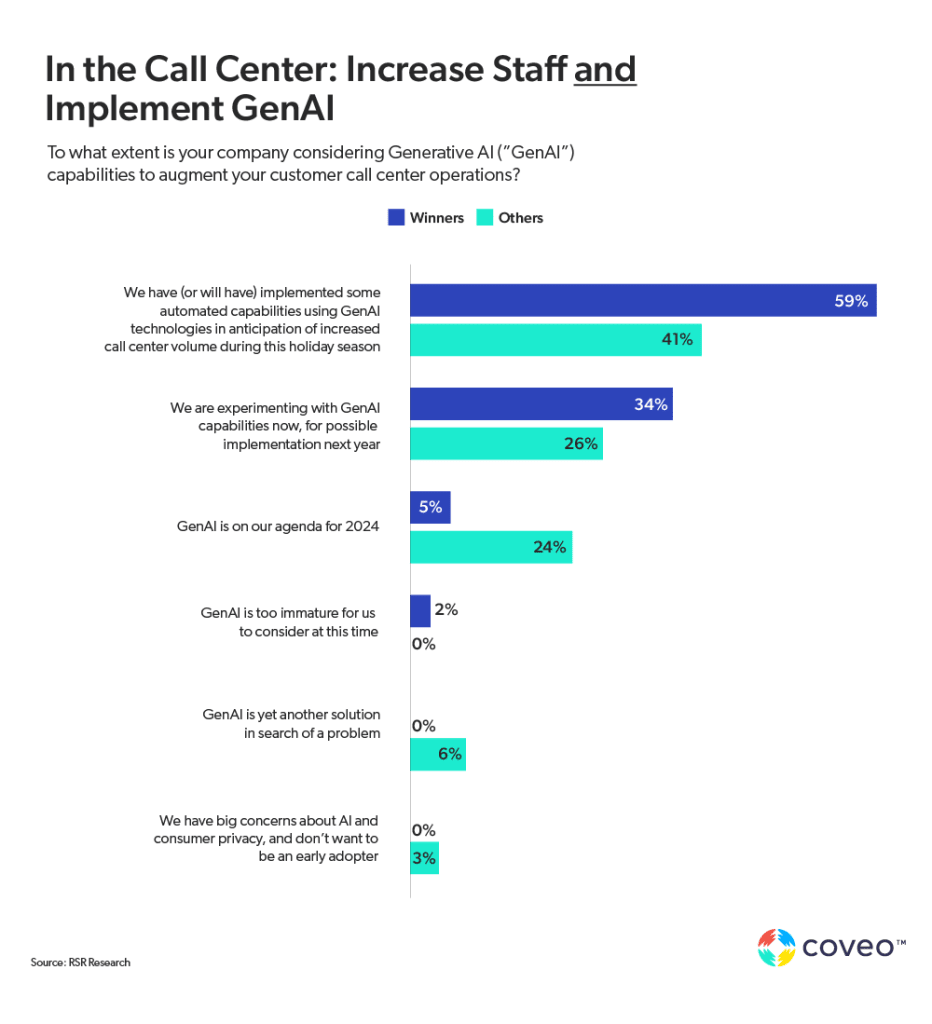

Generative AI – GenAI for short – is a retail game-changer. This isn’t lost on top performers who have adopted the technology much more quickly than other retailers. In fact, 93% of winners say GenAI plans are already in the works.

Digging deeper, we found:

- 59% of winners already have (or will have) implemented some kind of GenAI technology in their contact center for the holiday season.

- 34% of winners say they’re experimenting with GenAI capabilities in preparation for possible adoption in the new year.

- Underperformers are more likely to be late adopters, with 24% saying they’ll add GenAI to their agenda in 2024 compared to 5% of winners.

Three key opportunities for retail GenAI

In retail, GenAI can distill vast amounts of information held in product guides, how-tos, and other rich content into a simple conversational interaction with customers — and do so at scale. That’s why GenAI holds particularly great promise across three areas of the customer journey:

- Enablement: Helping customers research product features, understand purchase options, and select the right item.

- Inspiration: Giving shoppers new project ideas that align with their interests at every stage of their journey, such as décor ideas or new recipes.

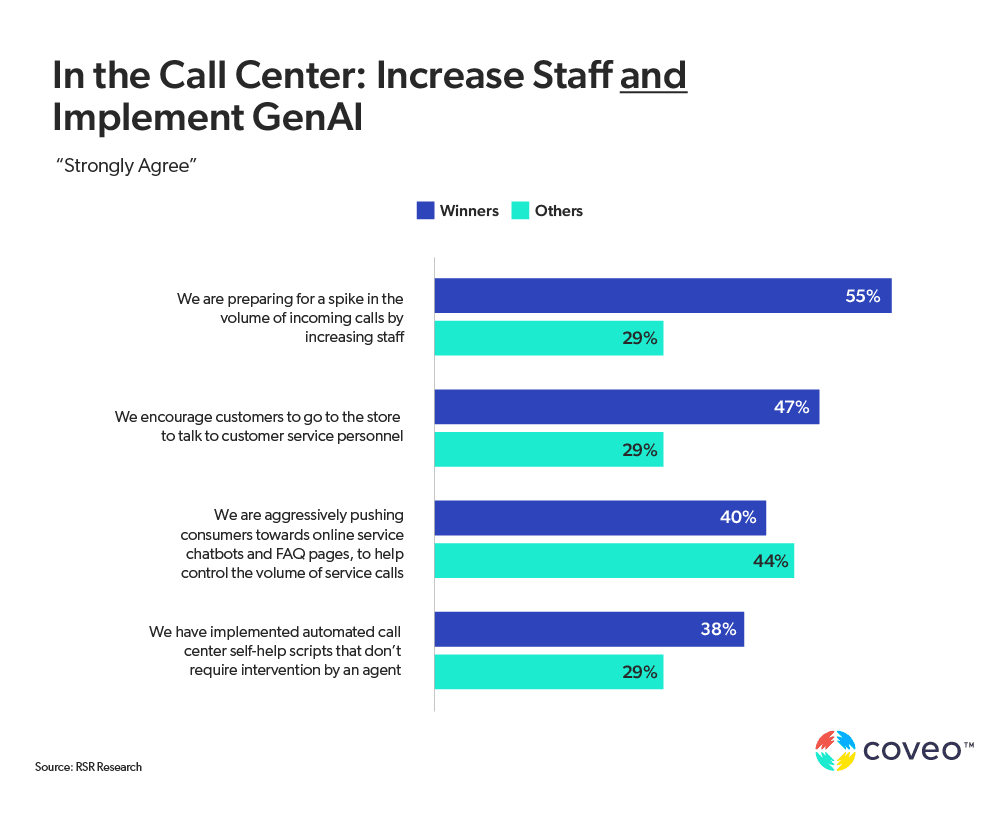

- Post-purchase support: 42% of surveyed retailers are aggressively pushing customers toward online service chatbots and FAQ pages to help manage call volume.

Ready to be a retail winner in 2024?

Whether your goal is to improve product discovery, boost conversions, or increase channel adoption, Coveo’s advanced functionality can help you get there. Watch this on-demand webinar to discover our latest AI innovations for cold-start products, RPV optimization, the evolution of the merchandising hub, improved reporting insights and generative answering.